Trading sentiment remains mixed amidst lack of major expiries

What to expect in the markets

There aren’t any major expiries to take note of for the day, making it tough to sort out trading sentiment after the mixed flows from Friday last week. The bond market continues to be a focus point as investors navigate through uncertain times.

Expire updates

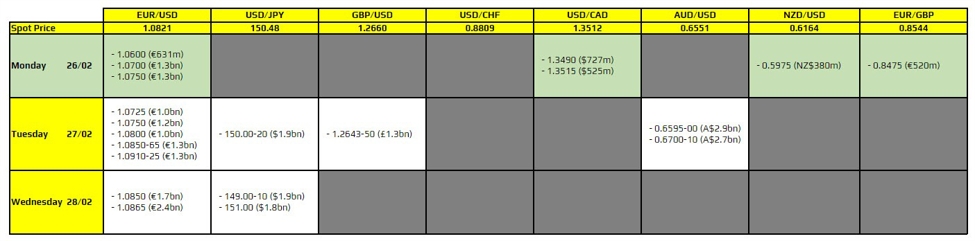

Keep in mind that expiries will be updated on a day-to-day basis, providing a more accurate picture of market movements. While the expiries board may cover up until Wednesday, they only serve as an indication for now.

Today, there are significant expiries for EUR/USD at 1.0700 and 1.0750, which could impact trading behavior in the short term.

Impact on individuals

For individual traders, the lack of major expiries may lead to increased volatility and uncertainty in the markets. It is crucial to stay informed and adapt to changing conditions to make informed decisions.

Global implications

The mixed trading sentiment and lack of major expiries could have a ripple effect on the global economy, leading to fluctuations in currency exchange rates and bond market movements. Investors worldwide will need to closely monitor developments to mitigate risks and seize opportunities.

Conclusion

As the markets continue to navigate through uncertain times, staying informed and adaptable will be key for traders and investors alike. Keeping an eye on expiries and market trends can help in making informed decisions in a rapidly changing environment.