Blog Post Article:

Fading the FOMC Minutes: A Strategy for Forex Traders

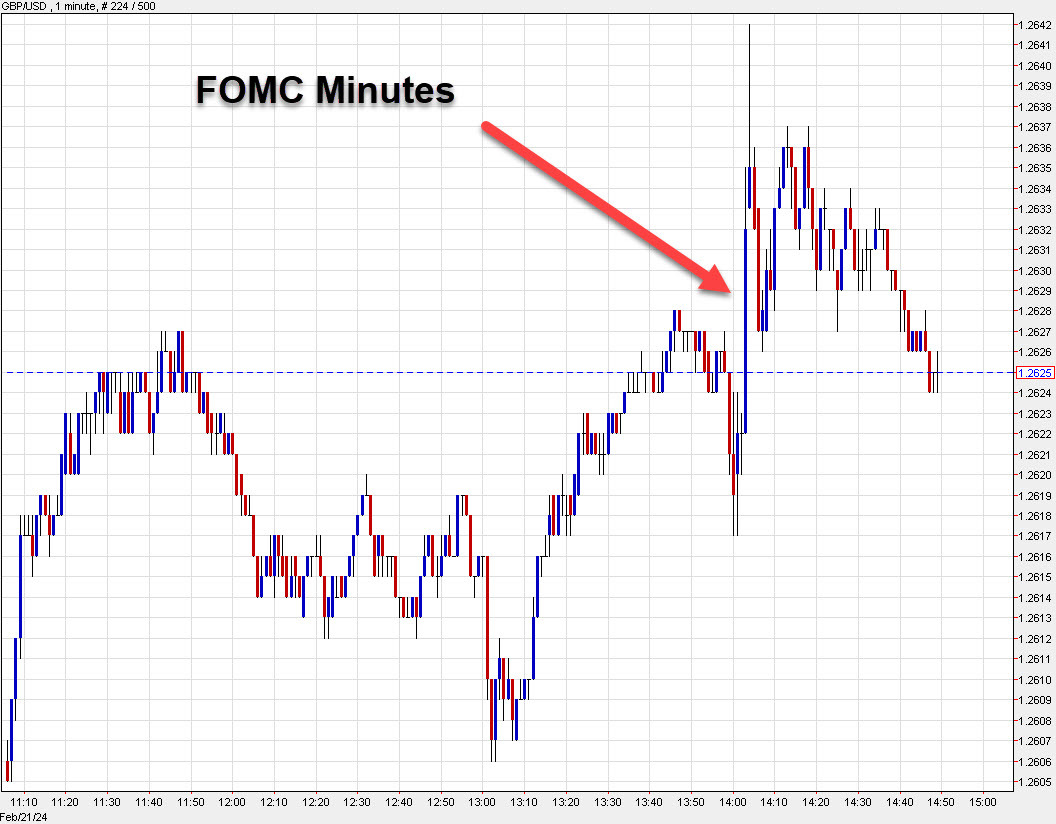

I don’t know if there’s a macro-data trade that has a hit-rate as strong as fading the FOMC Minutes. They’re stale by the time they’re released and there is never a single coherent message, so people can read them any way they like. In any case, the US dollar sagged on the release of the FOMC Minutes this month, only to recover the dip within the hour. To be fair, the moves were around 10 pips each way — hardly even a trade — but it fit the long-standing pattern.

The Minutes themselves were benign, with nothing particularly surprising or market-moving. This has become the norm with these releases, as the Fed tends to telegraph its intentions well in advance. Traders looking to capitalize on these moments can take advantage of the initial knee-jerk reactions of the market, knowing that they are often short-lived.

For forex traders, this strategy can provide an opportunity to make quick profits in a short amount of time. By fading the initial reaction to the FOMC Minutes, traders can enter and exit positions swiftly, capitalizing on the volatility without getting caught up in the longer-term implications of the news.

Impact on Individuals:

For individual forex traders, fading the FOMC Minutes can offer a way to profit from short-term market movements. By understanding the typical market reactions to these releases, traders can set themselves up for success in a fast-paced trading environment.

Impact on the World:

While fading the FOMC Minutes may not have a significant impact on the global economy as a whole, it can contribute to the overall liquidity and efficiency of the forex market. By providing opportunities for traders to capitalize on short-term movements, it adds depth and complexity to the market dynamics.

Conclusion:

Overall, fading the FOMC Minutes can be a valuable strategy for forex traders looking to make quick profits in a volatile market. By understanding the patterns and reactions associated with these releases, traders can position themselves for success in the ever-changing world of forex trading.