Getting a Sneak Peek at ForexLive Economic Data Calendar

What to Expect in the Forex Market

Understanding the Impact of New Zealand and Australia Data Releases

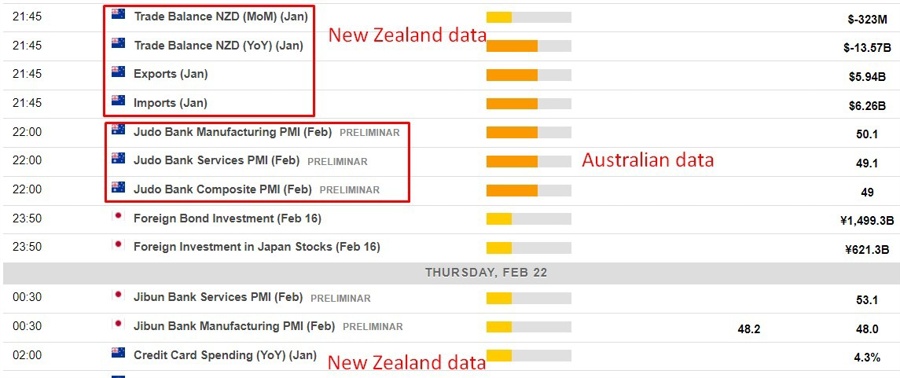

When it comes to keeping a pulse on the Forex market, having access to economic data is crucial. One tool that many traders rely on is the ForexLive economic data calendar, which provides a snapshot of upcoming data releases and their expected impact on the market. While there may not be major market-moving events on the horizon, it’s still important to stay informed and be prepared for any potential shifts in FX rates.

As we take a closer look at the data calendar, you’ll notice that the times listed are in GMT, making it easy to track when important announcements are scheduled to be released. The numbers in the rightmost column represent the previous month or quarter’s results, while the consensus median expected figures are listed next to them. This gives traders a clear picture of what to anticipate and how the market may react.

Specifically, data from New Zealand and Australia are worth paying attention to as these two countries play a significant role in the Forex market. The similarity of their flags can sometimes cause confusion, but their economic data can paint a different picture. By understanding the nuances of each country’s data releases, traders can make more informed decisions and potentially capitalize on any market movements.

How This Will Affect Me

For individual traders, keeping an eye on data releases from New Zealand and Australia can help in strategizing their trades. While these events may not cause major fluctuations in FX rates, they can still provide valuable insights into the health of these economies. By staying informed and adjusting trading strategies accordingly, traders can position themselves for success in the market.

How This Will Affect the World

On a larger scale, economic data from countries like New Zealand and Australia can have ripple effects across global markets. Any unexpected results or shifts in key indicators can influence investor sentiment and impact currency valuations worldwide. As such, keeping track of these data releases is important not just for individual traders, but for the broader financial landscape as well.

Conclusion

In conclusion, while the upcoming data releases may not be groundbreaking, they still hold significance for traders and the global market. By utilizing tools like the ForexLive economic data calendar and staying informed about key events, traders can navigate the FX market with confidence and readiness. Whether you’re trading on a personal level or considering the broader implications, being proactive and well-informed is key to success in the ever-changing world of Forex trading.