Options Expiry Levels Impacting Forex Prices

There are a couple of key levels to take note of in the forex market today. The options expiries are shaping up to influence price action for major currency pairs.

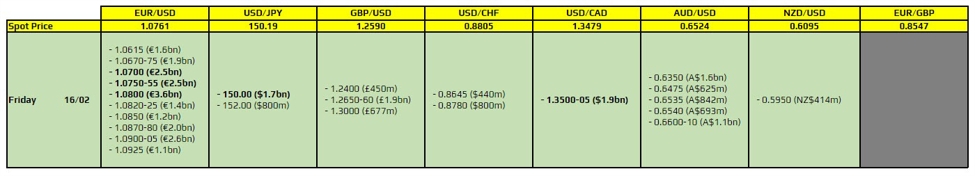

EUR/USD

The options expiries for EUR/USD are layered between 1.0700 to 1.0800, with some right in the middle of that range. This is likely to keep price action more contained at current levels, especially before the expiries roll off later in the day.

USD/JPY

There is one significant options expiry for USD/JPY at 150.00, which is likely to help keep price action more supported in European trading. This will be a factor to watch before more US data is released later in the day.

USD/C…

…

Impact on Traders

Traders need to be aware of these options expiry levels as they can influence price movements and volatility in the forex market. By understanding these key levels, traders can make more informed trading decisions and be prepared for potential market shifts.

Worldwide Implications

The impact of options expiry levels in the forex market extends beyond individual traders. These levels can affect overall market sentiment, liquidity, and global currency flows. It is essential for central banks, financial institutions, and policymakers to closely monitor these expiries to assess their implications on the broader economy.

Conclusion

In conclusion, options expiry levels play a significant role in shaping forex prices and market dynamics. By staying informed and vigilant about these key levels, traders and market participants can navigate the forex market more effectively and capitalize on trading opportunities.