U.S. Inflation to Fall Below 3% for First Time in Nearly Three Years

Introduction

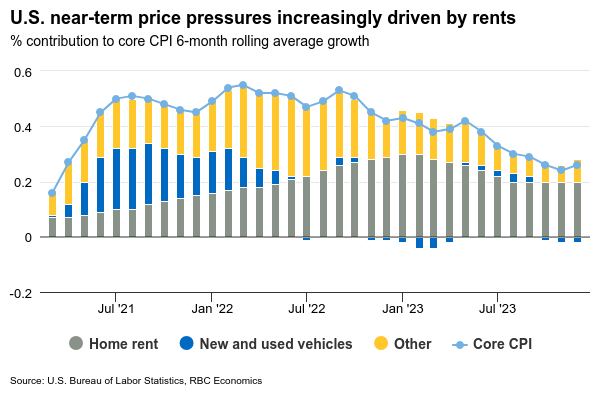

The U.S. retail sales and consumer price index reports for January will be closely watched for whether strong consumer spending and slowing inflation continue to unexpectedly coexist. The U.S. Federal Reserve remains wary that strong demand could reignite price growth, but to date, inflation has continued to edge broadly lower. Strong consumer spending and resilient labor market have been driving economic growth in the United States.

Analysis

With the latest data indicating that inflation is set to fall below 3% for the first time in nearly three years, this is welcome news for consumers. Lower inflation means that the cost of living will be more manageable for households, potentially freeing up more disposable income for spending. This could further boost consumer spending and help sustain economic growth in the country.

On the other hand, the Federal Reserve’s concern about strong demand reigniting price growth is still valid. If consumer spending continues to surge while inflation remains low, there is a risk that prices could pick up again. This delicate balance between consumer spending and inflation will be closely monitored in the coming months.

Impact on Individuals

For individuals, falling inflation means that the prices of goods and services are likely to remain stable or even decrease. This could lead to a lower cost of living, allowing people to stretch their budgets further and potentially save more money. However, if inflation remains low for an extended period, it could also signal underlying weaknesses in the economy that may impact job security and income growth.

Impact on the World

The U.S. economy plays a significant role in the global economy, so any changes in inflation rates in the country can have ripple effects around the world. A decrease in U.S. inflation could lead to lower prices for imported goods, benefiting consumers in other countries. It could also impact international trade dynamics and financial markets, as investors react to changes in U.S. economic indicators.

Conclusion

In conclusion, the expected fall in U.S. inflation below 3% for the first time in nearly three years is a significant development that will have implications for both individuals and the global economy. As consumers, we may benefit from lower prices and increased purchasing power, but we should also remain vigilant about potential risks to the economy. Keeping a close eye on inflation and consumer spending trends will be crucial in navigating the uncertain economic landscape ahead.