Last week’s financial markets were characterized by a mix of resilience, speculation, and divergent central bank signals

In the US, the narrative remained steadfast with Fed officials emphasizing a patient approach towards monetary policy

Firmly pushing back against the market’s eager anticipations for imminent rate cuts

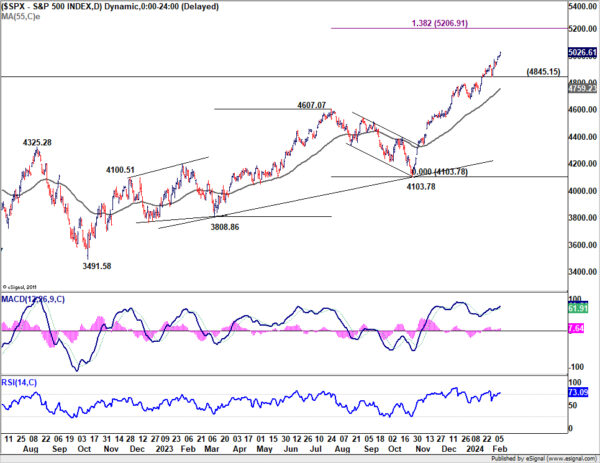

This cautious did little to dampen the spirits of investors, as major stock indices continued their upward trajectory

On the global front, the ECB hinted at the possibility of further stimulus measures to combat economic headwinds

While the Bank of Japan expressed concerns over the impact of trade tensions on the country’s export-driven economy

Central bankers around the world are working tirelessly to recast rate expectations amid uncertainties surrounding trade negotiations and geopolitical tensions

Yet market optimism remains unwavering, with investors optimistic about the potential for a resolution to trade disputes and continued economic growth

How this will affect me:

As a consumer and investor, the actions of central banks and the overall economic environment can have a direct impact on my purchasing power, investment returns, and overall financial well-being

While central banks are signaling a cautious approach to monetary policy, it is important to stay informed and make informed decisions about spending, saving, and investing

How this will affect the world:

The decisions made by central banks have far-reaching effects on the global economy, influencing trade flows, investment decisions, and overall economic stability

An uncertain economic environment can lead to increased volatility in financial markets, impacting businesses, consumers, and governments around the world

It is crucial for policymakers to continue working towards sustainable economic growth and stability to ensure a prosperous future for all nations

Conclusion:

Central bankers are facing a challenging economic landscape characterized by trade tensions, geopolitical risks, and divergent growth prospects

While market optimism remains high, it is important for investors and policymakers to remain vigilant and adaptive in the face of uncertainty

By working together to address key issues and promote economic stability, central bankers can help pave the way for a more prosperous and resilient global economy