Fedwatcher Calls US CPI Revisions a ‘Nothingburger’

The Skinny on Inflation Rates

Why the Market Should Care

So, it seems the latest CPI revisions are causing quite a stir in the financial world. The WSJ Fedwatcher isn’t mincing words when they called it a ‘nothingburger’. It’s almost comical how seriously we take these minute changes in inflation rates. I mean, who knew that excluding food and energy items could cause such a fuss?

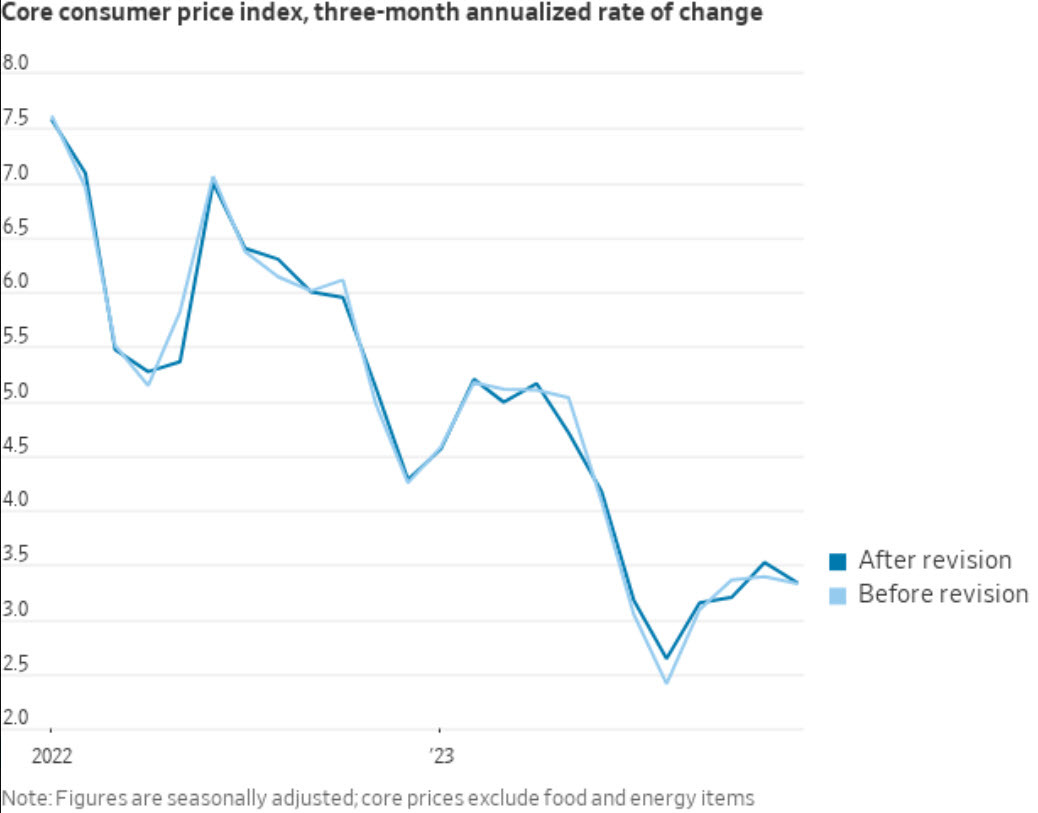

According to the Labor Department, core prices in the US rose 3.3% in December over the previous three months at an annualized rate. And guess what? That number remained unchanged from earlier figures. It’s like we’re all on the edge of our seats waiting for some dramatic shift in the numbers, only to be met with the same old story.

But hey, maybe there’s something to be said about consistency. The six-month annualized core inflation rate also held steady at 3.2% in December. It’s almost comforting in a way, like a boring movie you’ve seen a dozen times but can’t help watching again.

What I think the market is starting to watch a bit more closely is the underlying implications of these inflation rates. Sure, the numbers themselves might not be all that exciting, but what do they say about the overall health of the economy? Are we headed for rough waters or is this just a blip on the radar?

How This Affects You

While the CPI revisions might seem like a ‘nothingburger’ to the average person, they can actually have a real impact on your everyday life. With inflation rates holding steady, it could mean higher prices for goods and services in the long run. So, that grocery bill or gas fill-up might start to pinch your wallet a little more than usual.

On the flip side, steady inflation rates can also signal economic stability. It’s a delicate balancing act between keeping prices in check and ensuring growth. So, while you might not notice the effects right away, they could trickle down to your bottom line in the future.

Global Ramifications

But it’s not just about you and me. These CPI revisions could have far-reaching effects on the global economy as well. With the US being a major player in the world market, any shifts in inflation rates can send ripples across borders.

Investors and policymakers around the world will be keeping a close eye on how these numbers play out. It could influence everything from interest rates to trade agreements. So, while it might seem like a ‘nothingburger’ at first glance, it’s anything but when you consider the broader implications.

In Conclusion

So, next time you hear about the latest CPI revisions, just remember that it’s not just a ‘nothingburger’. These seemingly small changes can have a big impact on both your personal finances and the global economy. It’s a reminder that sometimes the most seemingly mundane things can pack a powerful punch in the world of finance.