Trading Sentiment Analysis

The Impact of Bond Market Movement on Trading Sentiment

By: Financial Expert

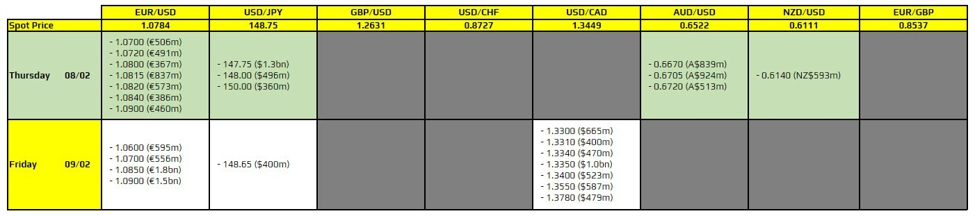

There aren’t any major expiries to take note of on the day. As such, trading sentiment will continue to be reliant on the action in the bond market and overall risk mood mostly. On the former, the push and pull this week is making it tough to gather much conviction. All eyes will slowly turn towards the US CPI data next week before any real inspiration perhaps.

I am going to be off tomorrow but barring any surprise changes, the expiries on Friday should not be too significant either. There will be…

Impact on Individuals

For individual traders, the reliance on bond market movement for trading sentiment means that market behavior may be more unpredictable and volatile. It is important for traders to closely monitor bond market trends and adjust their strategies accordingly to mitigate risks and capitalize on opportunities.

Global Economic Impact

The influence of bond market movement on trading sentiment can have significant effects on the global economy. Fluctuations in bond yields and investor sentiment can impact stock markets, currency exchange rates, and overall economic stability. It is crucial for policymakers and investors worldwide to monitor these developments closely and take appropriate measures to manage potential risks.

Conclusion

In conclusion, the relationship between bond market movement and trading sentiment is a key factor in shaping market dynamics. Individuals and global economies alike need to stay vigilant and adapt to changing conditions to navigate the challenges and opportunities presented by these trends.