New Zealand Inflation Data Preview

What to Expect

The upcoming release of New Zealand inflation data for the October-December quarter is highly anticipated. It is expected that inflation will continue to decline during this period, which would be seen as positive news for the Reserve Bank of New Zealand. The previous quarter’s results indicated a downward trend in inflation, so all eyes will be on this latest release to see if this trend has continued.

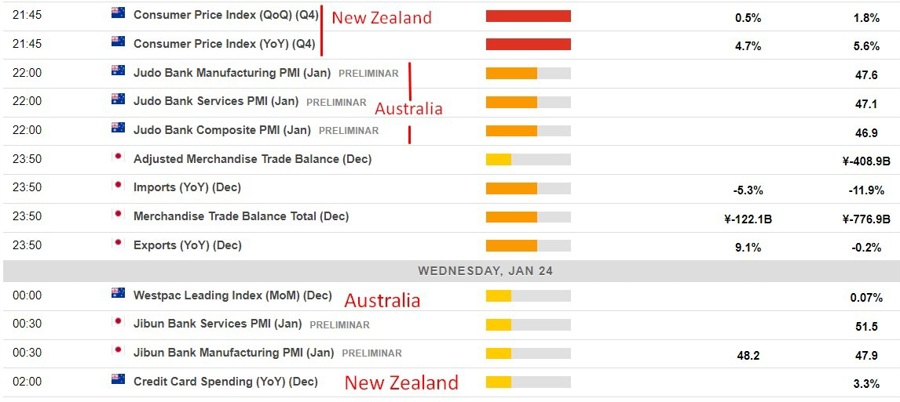

ForexLive Economic Data Calendar

Yesterday, a quick preview was posted on the ForexLive economic data calendar, giving traders and analysts a glimpse of what to expect. The calendar shows the times of the release in GMT, as well as the prior results from the previous quarter. This data is crucial for making informed decisions in the forex market.

The impact of this upcoming inflation data release on the New Zealand economy could be significant. A continued decline in inflation could signal economic weakness, prompting the Reserve Bank of New Zealand to consider further monetary stimulus measures to boost the economy. On the other hand, if inflation shows signs of stabilizing or increasing, it could indicate a healthier economic outlook and potentially lead to a more hawkish stance from the central bank.

How Will This Affect Me?

As a consumer in New Zealand, the inflation data release could have a direct impact on your purchasing power. Lower inflation may lead to lower prices for goods and services, which could be beneficial for consumers. On the other hand, if inflation remains low or continues to decline, it could signal economic challenges ahead, potentially leading to slower economic growth and job creation.

How Will This Affect the World?

The impact of New Zealand’s inflation data extends beyond its borders and can have ripple effects on the global economy. A weaker New Zealand economy could lead to decreased demand for imports, affecting trading partners around the world. Additionally, any decisions made by the Reserve Bank of New Zealand in response to the inflation data could influence global investor sentiment and market dynamics.

Conclusion

In conclusion, the upcoming release of New Zealand inflation data for the October-December quarter is a significant event that will be closely watched by investors, analysts, and consumers. The outcome of this data release could have far-reaching implications for the New Zealand economy and the global financial markets. It will be interesting to see how the Reserve Bank of New Zealand responds to the latest inflation figures and what this means for the future economic outlook.