J.P.Morgan Revises Interest Rate Outlook for European Central Bank

Sooner Rate Cuts Expected

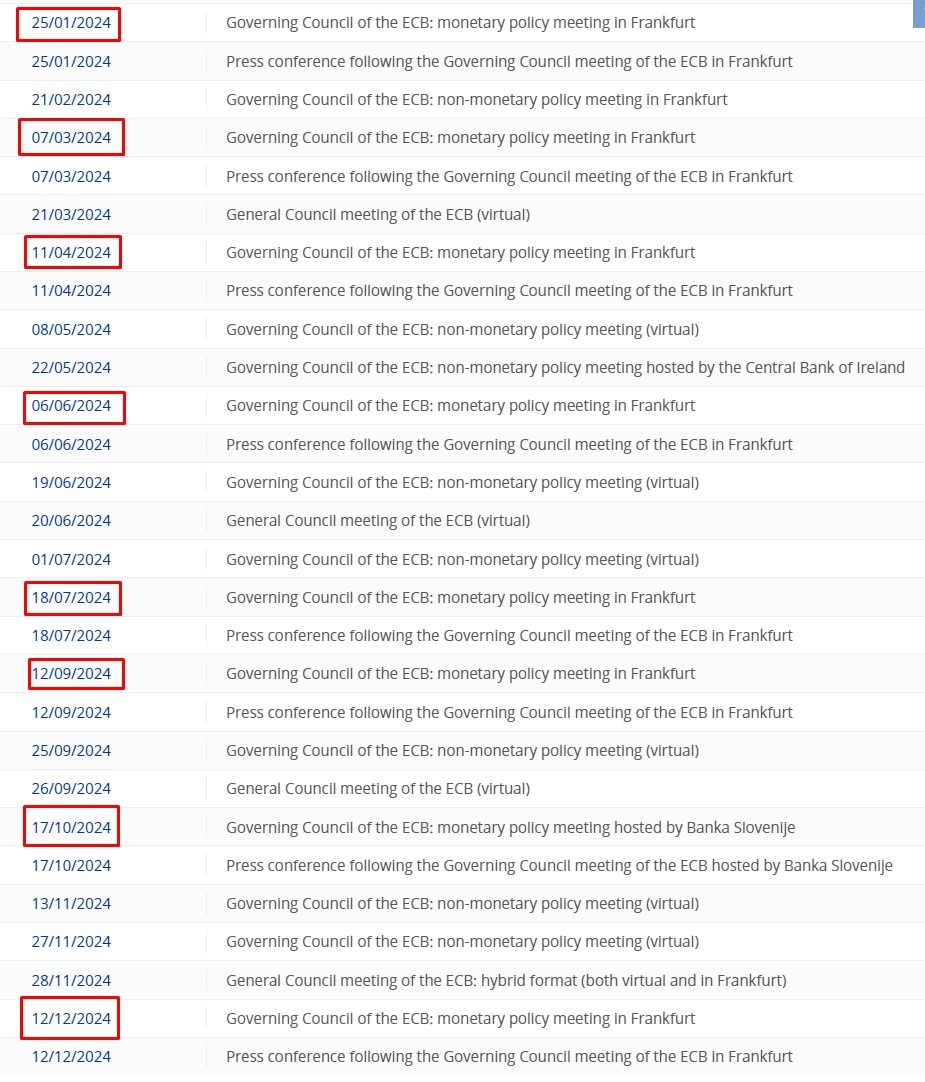

J.P.Morgan has recently revised its interest rate outlook for the European Central Bank (ECB). Previously, the firm expected the first rate cut to occur in September, but now they anticipate it as soon as June. The ECB is expected to hold rates in July, followed by cuts in both September and October.

Deeper Analysis

J.P.Morgan now predicts a total of 100 basis points (bps) in cuts, up from their previous estimation of 75 bps. Analysts at the firm are concerned about the trend in core inflation, noting its recent slowdown. They believe this deceleration may be due to transitory factors dissipating, making it challenging to discern the actual trend in inflation.

Impact on Individuals

For individuals, the revised interest rate outlook from J.P.Morgan could result in lower borrowing costs. If the ECB proceeds with the anticipated rate cuts, loans and mortgages may become cheaper, providing an opportunity for savings on interest payments.

Global Implications

The ECB’s decision to cut interest rates could have widespread ramifications on the global economy. Lower rates in the Eurozone may lead to increased investment and consumption, potentially stimulating economic growth not only in Europe but also in other parts of the world. However, these actions could also impact currency exchange rates and international trade dynamics.

Conclusion

In conclusion, J.P.Morgan’s revised interest rate outlook for the ECB signals a shift in expectations towards earlier and more substantial rate cuts. While this may benefit individuals through lower borrowing costs, the global implications of these decisions are complex and could influence economic trends on a broader scale.