DoubleLine Capital’s Jeffrey Sherman: March FOMC Rate Cut May Be Overly Optimistic

Description:

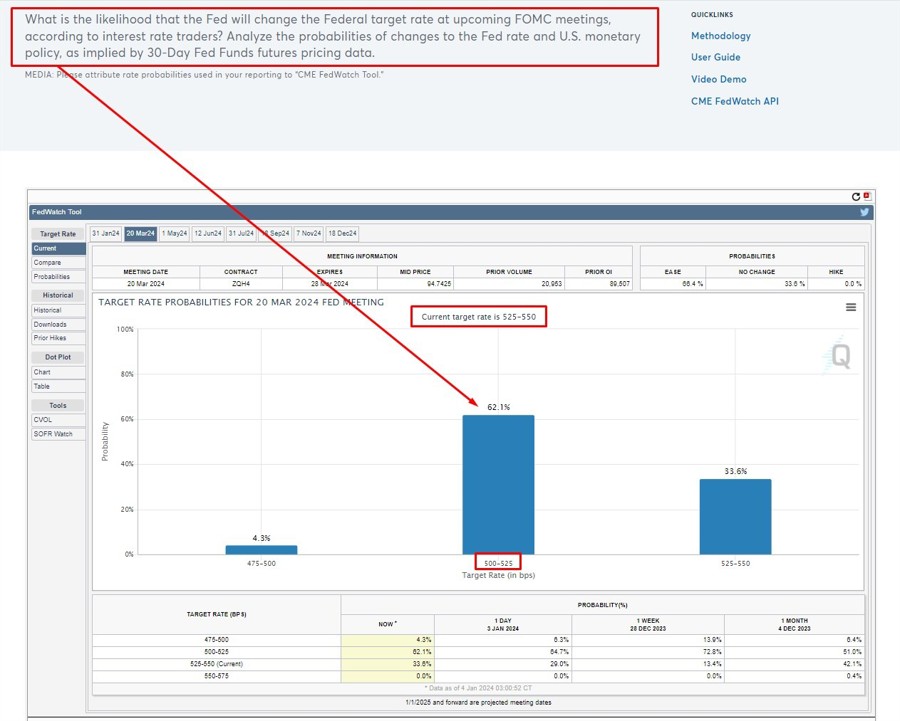

DoubleLine Capital’s deputy chief investment officer Jeffrey Sherman recently shared his thoughts in an interview with Bloomberg TV regarding the possibility of a rate cut by the Federal Open Market Committee (FOMC) in March. Sherman expressed his belief that the market may be overly optimistic in expecting a rate cut to happen as soon as March, despite the trajectory of core inflation and market expectations.

Blog Post:

Jeffrey Sherman, the deputy chief investment officer at DoubleLine Capital, is known for his professional and educated insights into the financial markets. In a recent interview with Bloomberg TV, Sherman discussed the possibility of a rate cut by the FOMC in March. He pointed out that while core inflation has shown signs of slowing down, it may be premature to assume that the Fed will quickly adjust its policy to lower rates.

Sherman highlighted the market’s expectations of a March rate cut as being overly optimistic. Despite current trends in core inflation, he cautioned against assuming that the Fed would move towards normalizing policy to a significantly lower rate in the near future. His perspective suggests a more cautious approach to predicting the Fed’s actions and their potential impact on the market.

As a profit-focused investor, Sherman’s viewpoint offers valuable insight into the complexities of monetary policy and market expectations. By analyzing the data and assessing the broader economic landscape, he brings a unique perspective to the conversation surrounding the FOMC’s upcoming decisions.

Impact on Me:

As an investor, the uncertainty surrounding the FOMC’s potential rate cuts in March could have a direct impact on my portfolio. If the market’s expectations do not align with the Fed’s actions, it may lead to increased volatility and fluctuations in asset prices. Staying informed and heeding Sherman’s cautionary outlook can help me make more informed decisions and navigate the market effectively.

Impact on the World:

Jeffrey Sherman’s perspective on the March FOMC rate cut has broader implications for the global economy. If the market’s optimism regarding a rate cut proves to be premature, it could affect international markets and investor sentiment. The Fed’s decisions have ripple effects that extend beyond domestic borders, and a divergence between expectations and outcomes could create challenges for global economic stability.

Conclusion:

In conclusion, DoubleLine Capital’s Jeffrey Sherman’s cautious stance on the March FOMC rate cut serves as a reminder of the complexities and uncertainties inherent in financial markets. His insights highlight the importance of a balanced approach to investing and the need to carefully assess the data before making investment decisions. By staying informed and proactive, investors can navigate market fluctuations and leverage opportunities that arise from shifting policy dynamics.