Rising Interest Rates Impact Australian Households and Businesses

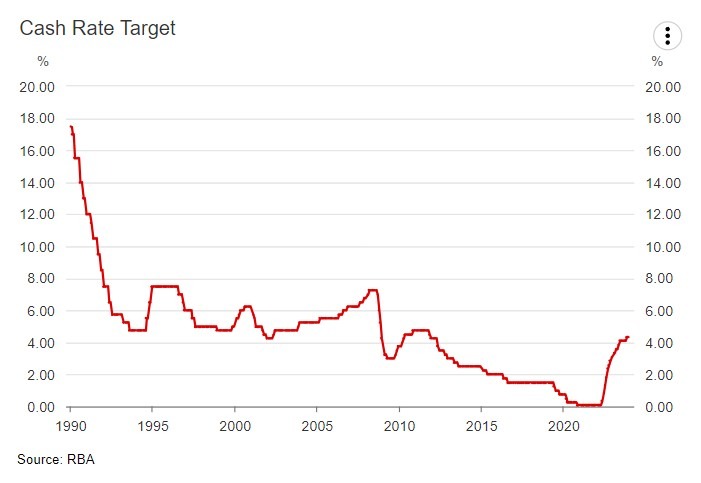

Internal documents from the Reserve Bank of Australia reveal insights into how rising interest rates have affected the economy.

Domestic tourism demand slips as cost-of-living pressures increase

The report shows that domestic tourism demand has slipped from high levels as households and businesses face increased cost-of-living pressures. Consumers are adjusting their spending habits by trading down to cheaper products or purchasing fewer items. This shift in consumer behavior is a direct result of the rising interest rates, which impact mortgage repayments and overall disposable income.

Additionally, private sector wage growth has stabilized at around 4%, indicating that businesses are also feeling the impact of higher interest rates. This has led to some organizations experiencing financial strain, particularly in the community services sector.

Cost-of-living pressures continue to weigh on households and businesses

Community services organizations are reporting that cost-of-living pressures remain acute for their constituents. This includes higher mortgage repayments, increased prices for essentials such as food and utilities, and overall decreased spending power. As a result, households are carefully managing their budgets and businesses are facing challenges in maintaining profitability.

The Reserve Bank of Australia is closely monitoring the situation and making adjustments to monetary policy to address the impact of rising interest rates on the economy.

How will this affect individuals like me?

As an individual, the impact of rising interest rates can be significant. Higher mortgage repayments and increased costs of living can put pressure on your finances. It is important to carefully manage your budget, consider refinancing options, and look for ways to increase your income or decrease your expenses to cope with the changing economic landscape.

How will this affect the world?

The effects of rising interest rates in Australia can have broader implications for the global economy. As one of the largest economies in the Asia-Pacific region, developments in Australia can influence trade, investment, and financial markets worldwide. It is important for policymakers and businesses around the world to monitor the situation and adjust their strategies accordingly to mitigate any potential risks.

Conclusion

The impact of rising interest rates on Australian households and businesses is significant, as evidenced by the findings in the Reserve Bank of Australia’s internal documents. It is crucial for individuals to proactively manage their finances and for policymakers to implement effective strategies to address the challenges posed by increasing cost-of-living pressures. By staying informed and adapting to the changing economic environment, we can navigate these challenges and work towards a more stable and prosperous future.