Dollar Gains Momentum as 2024 Begins with Global Equities Selloff

US Session Commences with Dollar Rebound

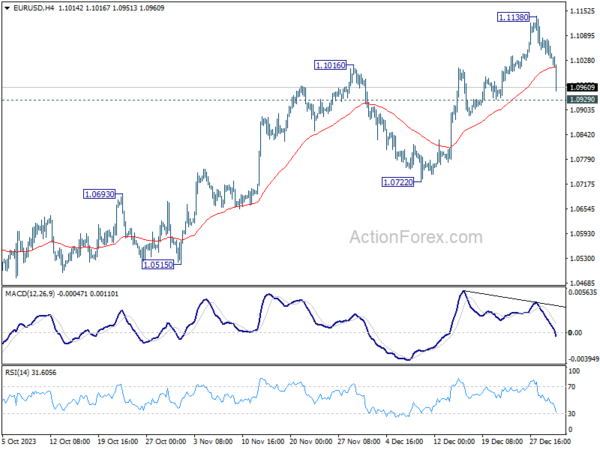

As the US session starts, the Dollar’s rebound is gaining additional momentum. This upswing is happening amidst an intensifying selloff in the equities market, primarily influenced by Apple’s downturn following a downgrade by Barclays over concerns of weakening sales. European majors are currently feeling the impact of the market’s shift.

It’s a tumultuous time in the financial markets as we kick off the new year. The Dollar’s rise is significant, especially in light of the current global economic climate. Investors are closely watching the developments in the equities market, particularly as concerns about Apple’s sales performance weigh on sentiment. The European markets are particularly vulnerable right now, as they navigate the shifting landscape.

While market fluctuations are nothing new, the current environment is fraught with uncertainty. The Dollar’s gaining momentum is a signal of shifting tides, and investors are bracing for what’s to come. As we move forward into 2024, it’s essential to stay informed and be prepared for any further upheavals in the financial markets.

Effects on Me

As an individual investor, the Dollar’s rebound and the global equities selloff could have direct implications on my investment portfolio. It’s crucial to assess the current market conditions and make informed decisions to mitigate any potential risks. Diversification and staying updated on market developments will be key in navigating the uncertain times ahead.

Effects on the World

The ongoing Dollar momentum and global equities selloff could have far-reaching effects on the global economy. Increased market volatility and uncertainty may impact trade relationships, consumer confidence, and overall economic growth. It’s essential for world leaders and policymakers to closely monitor the situation and take appropriate measures to stabilize the markets and prevent a broader economic downturn.

Conclusion

As we embark on a new year with the Dollar gaining momentum and global equities experiencing a selloff, the financial markets are in a state of flux. It’s a time for caution, vigilance, and strategic decision-making. By staying informed, remaining adaptable, and seeking guidance from financial experts, investors can weather the storm and navigate the uncertain terrain ahead.