US Consumer Confidence on the Rise

What the Numbers Say

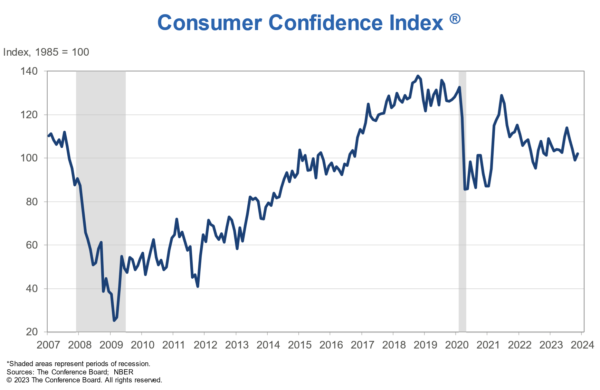

The US Conference Board Consumer Confidence rose from 99.1 to 102.0 in November, surpassing expectations of 101.0. The Present Situation Index saw a slight dip from 138.6 to 138.2, while the Expectations Index increased from 72.7 to 77.8. However, it is notable that the Expectations Index has remained below 80 for the third consecutive month, a level that historically indicates a recession within the next year.

Interpreting the Data

Consumer confidence is a key indicator of the health of the economy. When consumers are feeling confident about their current financial situation and future prospects, they are more likely to spend money, which in turn boosts economic growth. The rise in consumer confidence to 102.0 is certainly a positive sign, reflecting a sense of optimism among the general public. However, the fact that the Expectations Index is still below 80 raises concerns about the long-term economic outlook.

Implications for Individuals

Based on this data, individuals may feel more secure in their current financial situation and be more willing to make discretionary purchases. However, the lingering uncertainty reflected in the Expectations Index could lead to cautious spending habits and saving for the future.

Global Impact

The US economy is a major player in the global market, so any fluctuations in consumer confidence can have a ripple effect worldwide. If the Expectations Index continues to signal a potential recession, it could lead to a decrease in consumer spending, which would not only impact the US economy but also have ramifications for global trade and financial markets.

Conclusion

While the rise in US consumer confidence is a positive development, the lingering concerns highlighted by the Expectations Index cannot be ignored. It will be important to monitor future economic data closely to gauge the trajectory of the economy and take appropriate measures to mitigate any potential downturns.