EUR/CHF Weekly Outlook

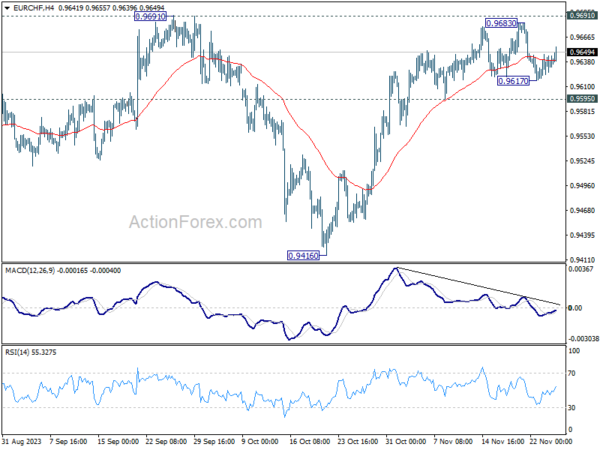

EUR/CHF failed to break through 0.9691 resistance last week and retreated

Overview

EUR/CHF had a volatile week, initially failing to break through the key resistance level of 0.9691 but then bouncing back after a brief dip to 0.9617. The currency pair’s performance has been mixed, and the initial bias remains neutral for the upcoming week with the possibility of further consolidations.

There is still an expectation of a rally in the EUR/CHF pair, especially if there is a decisive break of the 0.9691 resistance level. This break would carry a larger bullish implication and could potentially target the next resistance level of 0.9840. However, a break of the support level at 0.9595 could change the outlook for the pair.

Impact on Me

As an individual forex trader, the developments in the EUR/CHF pair will impact my trading decisions. A decisive break of the resistance level could signal a buying opportunity, while a break of the support level could lead to a shift towards a bearish outlook.

Impact on the World

The performance of the EUR/CHF pair is closely watched by investors and analysts as it reflects the overall sentiment in the Eurozone and Switzerland. A bullish trend in the pair could indicate a positive outlook for the European economy, while a bearish trend could raise concerns about economic stability in the region.

Conclusion

In conclusion, the EUR/CHF pair is currently in a consolidation phase with the potential for a further rally if the key resistance level is broken. As a trader, it is important to closely monitor the developments in the pair and adjust trading strategies accordingly to capitalize on potential opportunities.