The USD is moving to new session lows vs all major currencies

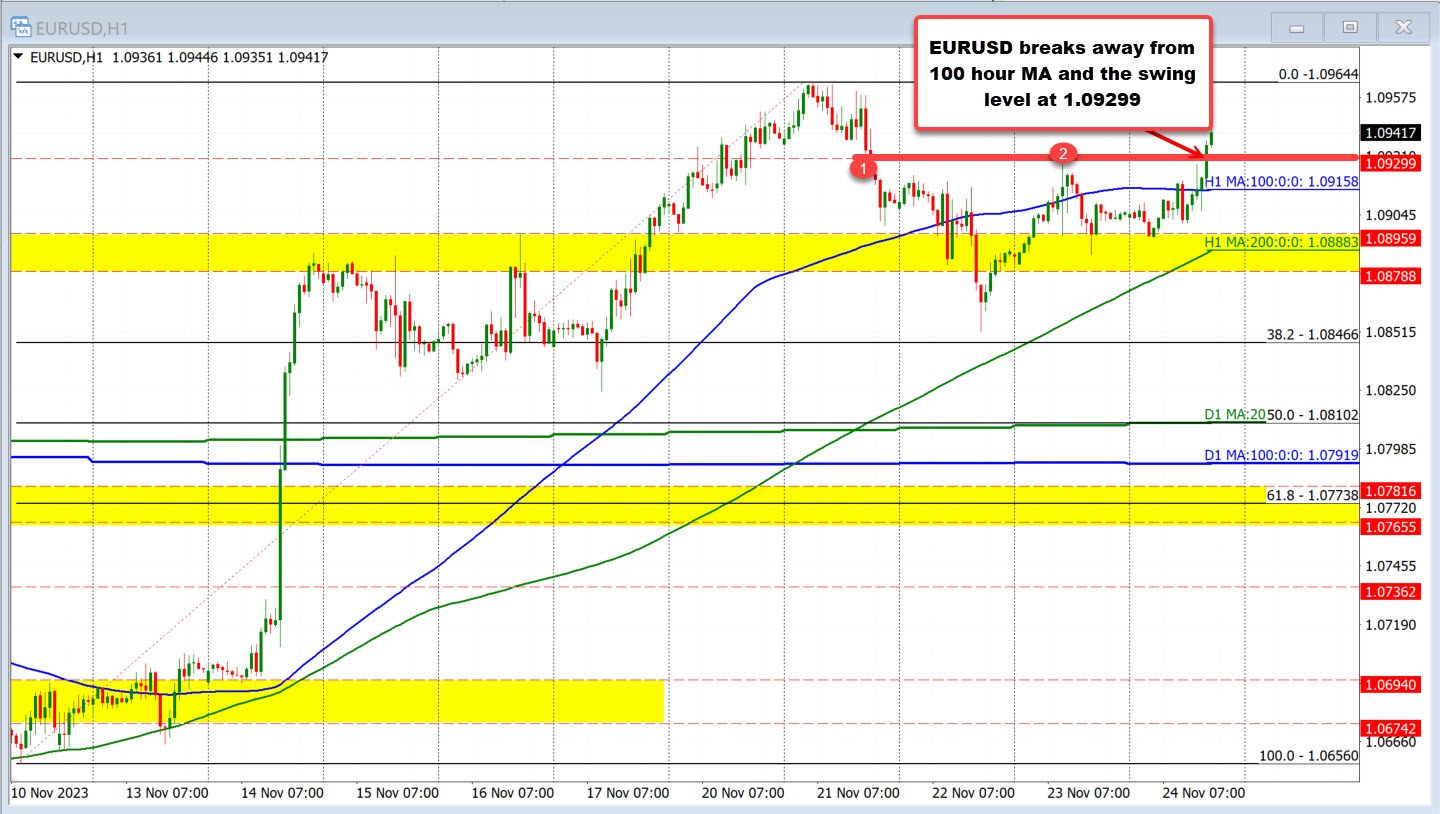

EURUSD: EURUSD moves from 100 hour MA

The USD is currently moving to new session lows against all major currencies except for the JPY. This comes as a surprise, considering the rise in US yields. The US 2-year yield is up 3.2 bps, the 10-year yield is up 5.8 bps, and the 30-year yield is up 5.6 bps. Despite these increases, the USD is still struggling against other currencies.

In particular, the EURUSD pair has moved above the high from yesterday at 1.09299 and is now looking towards the high for the week at 1.09644. The pair began the US trading session fluctuating above and below the 100-hour MA at 1.09158 after finding support during the Asian trading session.

Effect on Me

As an individual, the weakening USD can have both positive and negative effects on you. If you are an importer, a weaker USD means you will need to pay more for imported goods and services. However, if you are a traveler planning to visit countries where the USD is stronger, this could work in your favor as your money will go further.

Effect on the World

The USD moving to new session lows against major currencies can have a significant impact on the global economy. A weaker USD can lead to a boost in exports for countries that rely on trade with the US. On the flip side, it can also lead to higher inflation in the US and potentially impact global markets.

Conclusion

In conclusion, the USD’s movement to new session lows against major currencies is a noteworthy development that could have wide-reaching implications. It is essential to monitor how this trend continues and be prepared for any potential consequences it may bring.