Morning Thoughts from Capital Edge’s Arno Venter

Powell’s Comments: A Closer Look

In terms of Powell’s comments, I have seen a lot of takes on his comments with the majority saying Powell was ‘very hawkish’, ‘overly hawkish’ or ‘more hawkish than expected’. I offer you exhibit a (Powell’s comments from 1 Nov): And exhibit b (Powell’s comments last night). If we are really honest with ourselves the comments from last night are not really different from what we heard last week. I think the b…

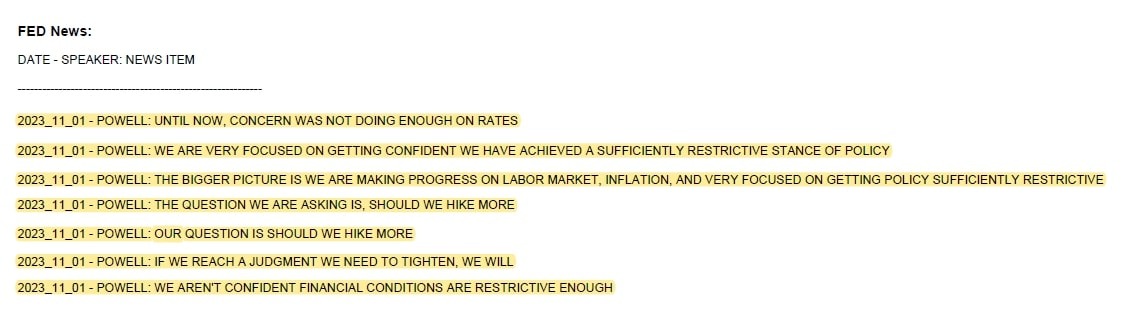

Exhibit a: Powell’s comments from 1 Nov

Exhibit b: Powell’s comments last night

It is clear that there is some disagreement among analysts about the tone of Powell’s recent comments. Some believe he is taking a more aggressive stance than before, while others argue that his latest remarks are consistent with previous statements.

Let’s delve deeper into the potential implications of Powell’s comments and how they could impact both individuals and the global economy.

Impact on Individuals

For individuals, Powell’s hawkish comments could mean higher interest rates in the near future. This could affect borrowing costs for things like mortgages, auto loans, and credit cards. If interest rates increase, it may become more expensive to take out loans, leading to decreased consumer spending and potentially slower economic growth.

Additionally, investors may react negatively to the prospect of higher interest rates, causing fluctuations in the stock market and potentially impacting retirement savings and investment portfolios.

Impact on the Global Economy

On a larger scale, Powell’s comments could have ripple effects across the global economy. As the chair of the Federal Reserve, Powell plays a key role in shaping monetary policy that can influence international markets and trade relationships.

If the Federal Reserve decides to raise interest rates in response to inflation concerns, it could have an impact on emerging markets and developing economies that rely heavily on foreign investment and exports. A shift in US monetary policy could lead to changes in exchange rates, trade flows, and economic growth prospects for countries around the world.

Conclusion

As we analyze Powell’s recent comments, it’s important to consider the potential implications for both individuals and the global economy. While interpretations may vary, it is clear that any changes in monetary policy could have far-reaching consequences that impact us all. It will be crucial to monitor future developments and adapt to the changing economic landscape accordingly.