UBS Response to Australian Inflation Data Upside Surprise

UBS Predicts RBA Cash Rate Hike in November Meeting

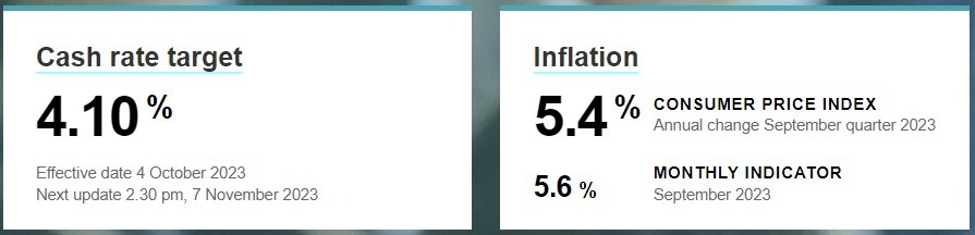

Following Wednesday’s upside surprise in Australian inflation data, UBS’s Australian economist has forecasted a 25 basis point Reserve Bank of Australia cash rate hike at its November 7 meeting. According to UBS, “RBA Governor Bullock’s speech last night effectively specified they ‘will not hesitate to raise the cash rate further’ – implying a hike of 25 basis points at their November meeting – ‘if there is a material upward revision to the outlook for inflation’”

UBS has been warning for several months about the significant risk of the RBA raising the cash rate. With the recent inflation data pointing towards a stronger economic outlook, UBS believes that a rate hike is imminent.

How This Announcement Will Affect Me

As a consumer or borrower, a potential cash rate hike by the RBA could mean higher interest rates on loans and mortgages. This could result in increased borrowing costs and potentially impact spending habits or investment decisions.

How This Announcement Will Affect the World

The decision by the Reserve Bank of Australia to raise the cash rate could have broader implications for the global economy. A rate hike in Australia may signal a shift towards tighter monetary policy globally, affecting international exchange rates and potentially impacting global financial markets.

Conclusion

In conclusion, UBS’s response to Wednesday’s inflation data and their prediction of a cash rate hike by the RBA in November indicate a changing economic landscape in Australia. As we wait for the RBA’s decision, it is important for individuals and businesses to stay informed about potential impacts on borrowing costs and global economic trends.