Breaking Down the GBPUSD Price Movement

What’s Happening in the Forex Market

Understanding the Current Dynamics

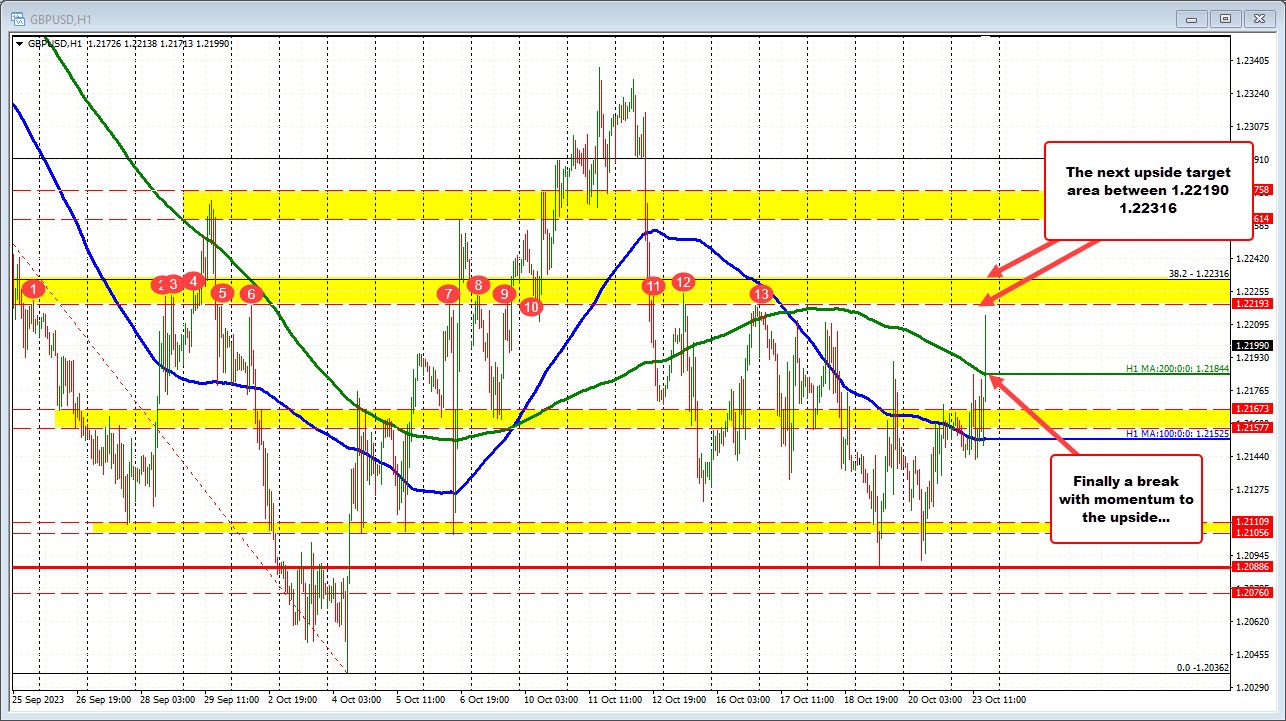

The GBPUSD buyers are breaking the price of the pair higher, and in the process are extending above it at 200 hour moving average with momentum at 1.21844. That level will now be a risk level for buyers. Staying above is more bullish.On the top side, there is a swing area between 1.2219 and 1.22316. That would be the next target area to get to and through to open the door for further upside momentum.

Earlier today, the sellers had their shot below the 100-hour moving average on a number of different attempts. Those attempts failed, and the price moved back higher. Today, the buyers are taking the price away from that level and have extended above the high from yesterday’s trade at 1.21844. That level represents the high price going back to January 13, 2020.

How Will This Affect Me?

As an individual investor or forex trader, the movement in the GBPUSD pair can have direct implications on your portfolio or trading strategy. A breakout above key levels like the 200-hour moving average and swing areas could signify a bullish trend, potentially opening up opportunities for profitable trades. However, it is important to closely monitor the price action and risk levels to make informed decisions.

How Will This Affect the World?

In the broader scope of things, movements in major currency pairs like GBPUSD can impact global financial markets and economies. A bullish trend in the GBPUSD pair could signal confidence in the British economy or monetary policies, influencing forex markets and international trade relationships. Traders, financial institutions, and policymakers around the world will be keeping a close eye on these developments and adjusting their strategies accordingly.

Conclusion

Overall, the current price movement in the GBPUSD pair reflects a shifting balance of power between buyers and sellers in the forex market. By understanding the key levels and dynamics at play, traders can better navigate the uncertainty and capitalize on potential opportunities. Whether you’re a retail investor or a world economic leader, staying informed and adaptable is key in reacting to these market fluctuations.