Bill Gross’ Economic Predictions: What to Expect

The Retired Bond King’s Insights

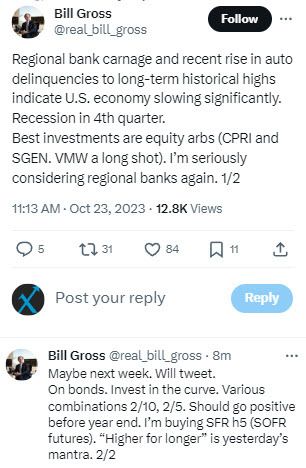

First Bill Ackman, now Bill Gross. The retired bond king has recently made some bold predictions about the state of the U.S. economy, and investors are taking note. Gross, known for his successful career in the world of fixed-income investments, has a reputation for being outspoken and often accurate in his assessments.

Gross has pointed to signs of trouble in the U.S. economy, highlighting the recent struggles of regional banks and a concerning rise in auto delinquencies to long-term historical highs. These indicators, according to Gross, suggest that the U.S. economy is slowing significantly and could be headed for a recession as soon as the fourth quarter.

Investment Recommendations

In light of his predictions, Gross has shared his thoughts on the best investment opportunities in this challenging economic environment. He has advised that equity arbitrage opportunities, such as CPRI and SGEN, could be promising choices for investors. Additionally, Gross has mentioned VMW as a potential long shot that could pay off for those willing to take the risk.

Interestingly, Gross has also hinted at the possibility of reevaluating regional banks as potential investments. This shift in mindset from the seasoned investor could have significant implications for the financial sector and could influence the decisions of other market participants.

Looking Ahead

Despite the uncertainty surrounding the timing of his next move, Gross has alluded to the fact that he will share his thoughts on bonds in the near future, possibly through social media platforms like Twitter. He has suggested that investing in the curve, through various combinations like 2/10 and 2/5, could be a strategic move for investors to consider. Gross believes that these yield curve strategies could prove profitable as the economic landscape evolves.

Impacts on Individuals and the Global Economy

Based on Bill Gross’ economic predictions, individuals may want to reassess their investment portfolios and consider shifting towards the opportunities he has highlighted. By following his advice on equity arbitrage and bond strategies, investors could position themselves advantageously in the face of potential economic downturns.

On a broader scale, Gross’ insights could have ripple effects on the global economy. If his predictions of a U.S. recession come to fruition, it could lead to increased market volatility, lower consumer spending, and potential job losses. International markets may also be impacted as investors react to the changing economic landscape and adjust their strategies accordingly.

Conclusion

Bill Gross’ economic predictions offer valuable insights for investors navigating today’s uncertain financial markets. By heeding his advice on investment opportunities and bond strategies, individuals can position themselves for success in a potentially challenging economic environment. Additionally, the implications of Gross’ forecasts extend beyond individual investors, as they could shape the actions of market participants worldwide and influence the direction of the global economy.