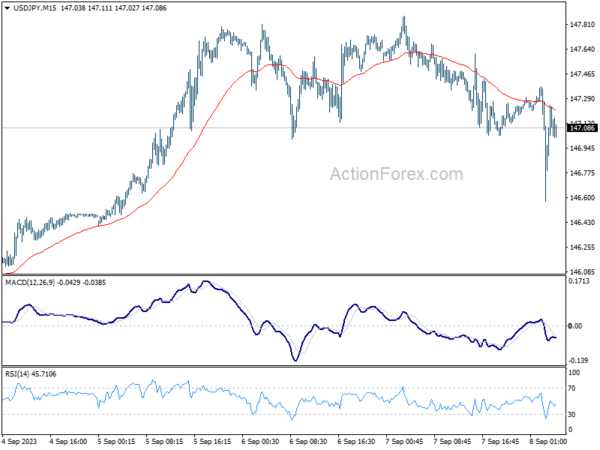

USD/JPY dips briefly after Japan Suzuki’s verbal intervention

Japan’s Finance Minister Shunichi Suzuki said today that the government is closely watching the currency market’s developments with a “heightened sense of urgency.” His comments reverberate a growing concern amidst Japanese policymakers about the recent depreciation of Yen.

Suzuki emphasized that “appropriate action” would be taken to counter any excessive volatility, without ruling out any measures. This statement comes as the USD/JPY pair experienced a brief dip following Suzuki’s verbal intervention.

Impact on Me:

As an individual, the fluctuations in the exchange rate between the US Dollar and Japanese Yen may affect me if I have investments or business dealings in either currency. The intervention by Japan’s Finance Minister could potentially lead to changes in the value of these currencies, impacting the financial landscape for individuals like myself.

Impact on the World:

The verbal intervention by Japan’s Finance Minister in the currency market could have ripple effects globally. The USD/JPY pair is one of the most traded currency pairs in the world, and any significant changes in its value can impact international trade and financial markets. The actions taken by Japanese policymakers to address currency volatility could potentially influence currency exchange rates and trade relations on a global scale.

Conclusion:

In conclusion, Japan’s Finance Minister Shunichi Suzuki’s verbal intervention has caused a brief dip in the USD/JPY pair, reflecting heightened concerns about currency market developments. The impact of these actions can be felt both at an individual level, affecting personal finances, and on a broader global scale, impacting international trade and financial markets.