Finding the Perfect Balance in the Stock Market

The Battle Between SMAs and Technical Oscillators

Picture this: the stock market is like a high-stakes game of chess, where every move could either make or break your portfolio. As an investor, you’re constantly analyzing trends and patterns to stay one step ahead of the game. But what happens when conflicting signals start to pile up, leaving you scratching your head in confusion?

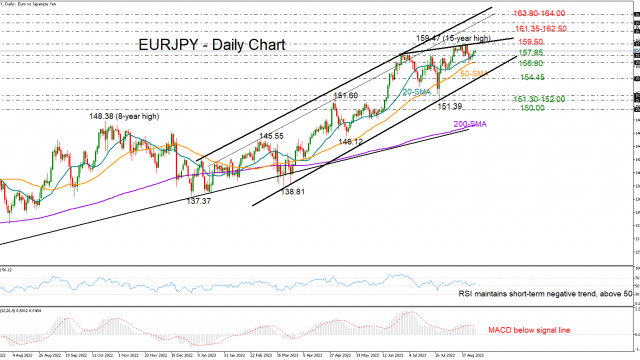

Take the recent market scenario, for example. The upward-sloping SMAs paint a rosy picture, hinting at a positive trend in the market. On the other hand, the technical oscillators cast a shadow of doubt, unable to provide a strong endorsement for bullish momentum in the coming sessions. It’s like trying to solve a puzzle with missing pieces, where every clue leads to a dead end.

The RSI and MACD Dilemma

Let’s dive a little deeper into the technical jargon. The RSI, a popular momentum indicator, is currently on a negative trajectory above its 50 neutral mark, despite showing signs of improvement recently. Meanwhile, the MACD is playing hard to get, stubbornly hovering below its red signal line. This discrepancy signals a level of skepticism among investors, unsure of which direction to take.

How Does This Affect You?

As an individual investor, these conflicting signals can be both a blessing and a curse. On one hand, the positive SMAs may entice you to jump on the bullish bandwagon, expecting a rise in stock prices. On the other hand, the technical oscillators’ lackluster performance might make you think twice before making any hasty decisions. It’s a delicate balancing act, requiring a keen eye and a steady hand to navigate through the uncertainty.

How Does This Affect the World?

In the grand scheme of things, the tug-of-war between SMAs and technical oscillators reflects the broader sentiment in the market. The uncertainty and skepticism among investors can create ripple effects that impact global economies and financial systems. A lack of consensus on market direction can lead to increased volatility and instability, making it crucial for market participants to tread cautiously.

In Conclusion…

When it comes to navigating the complexities of the stock market, finding the perfect balance between conflicting signals is key. While the upward-sloping SMAs offer a glimmer of hope, the technical oscillators serve as a reality check, reminding us of the inherent uncertainties in investing. In a world where trends can change in the blink of an eye, it’s important to stay informed, stay vigilant, and most importantly, stay adaptable.