Data reveals sluggish expansion in China’s services activity

The impact on the global economy

In recent news, data has revealed a sluggish expansion in China’s services activity, signaling a faltering post-pandemic recovery for the world’s second-largest economy. This news has sent shockwaves through the financial markets, with traders anxiously awaiting the release of the minutes from the Federal Reserve’s recent meeting.

What does this mean for AUD/USD price analysis?

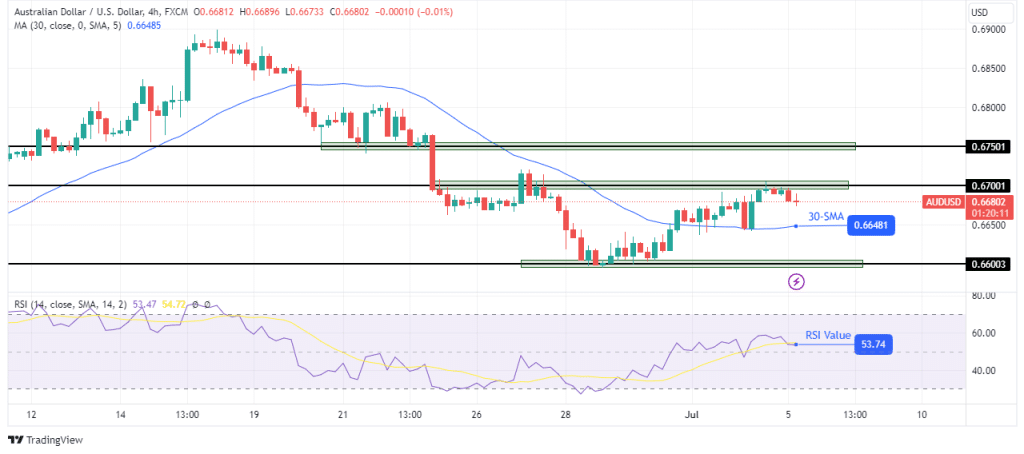

Today’s AUD/USD price analysis is bearish, as Australia’s dollar weakened in response to the data revealing the slow expansion in China’s services activity. This weakness is exacerbated by the depreciation of the Chinese yuan, creating a challenging scenario for traders and investors alike.

The impact on individuals

For individual investors, the sluggish expansion in China’s services activity could have wide-reaching implications. As Australia’s dollar weakens and global markets react to the news, it’s important for investors to stay informed and consider diversifying their portfolios to mitigate potential risks.

The impact on the global economy

The faltering post-pandemic recovery in China could have ripple effects on the global economy. As one of the world’s largest trading partners, any slowdown in China’s economic growth could disrupt supply chains, impact global trade, and have broader implications for the stability of the international financial system.

Conclusion

In conclusion, the data revealing a sluggish expansion in China’s services activity is a concerning development for the global economy. As traders await the release of the Federal Reserve’s meeting minutes, it’s clear that market volatility is likely to persist in the near term. It’s more important than ever for individuals and policymakers alike to monitor the situation closely and take proactive steps to address any potential challenges that may arise.