The Coming Wave of Copper Demand: Insights from Max Layton

Overview

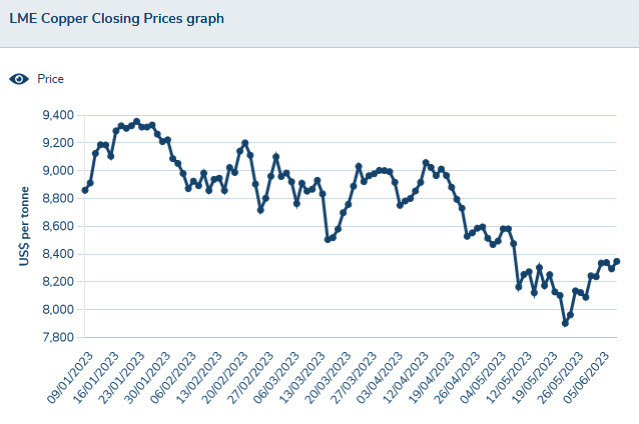

Max Layton, Citi’s managing director for commodities, was featured in a Bloomberg story today discussing the anticipated surge in copper demand. According to Layton, LME copper prices are currently at $8,300, but he predicts that they could easily rise to $12,000-15,000 by 2025. This increase in price is expected as the limited supply meets the growing demand for copper driven by electrification trends.

Key Points

In the Bloomberg article, Layton highlighted the unique role that copper plays in the decarbonization efforts within the commodities market. He emphasized that copper is the most liquid commodity and the preferred choice for investments in decarbonization. Layton also pointed out that copper’s distinctive characteristics make it an essential component in various industries.

Implications for Individuals

Given the projected rise in copper prices, individuals may face higher costs for products that rely on copper, such as electronic devices, automobiles, and infrastructure projects. This increase in prices could impact household budgets and overall consumer spending.

Global Impact

The surge in copper demand could have far-reaching effects on the global economy. As copper prices soar and supply struggles to keep up with demand, industries reliant on this metal may face challenges in production and expansion. The shift towards electrification and sustainable practices may drive up the demand for copper even further, leading to potential changes in trade dynamics and market stability.

Conclusion

Max Layton’s insights on the forthcoming wave of copper demand shed light on the opportunities and challenges that lie ahead for the commodities market. As copper prices continue to climb in response to growing electrification demand, individuals and industries alike must adapt to the changing landscape to navigate the impacts of this shift effectively.