Trading Week Recap: A Look Back at the Exciting Market Movements of June 5-9, 2023

Description:

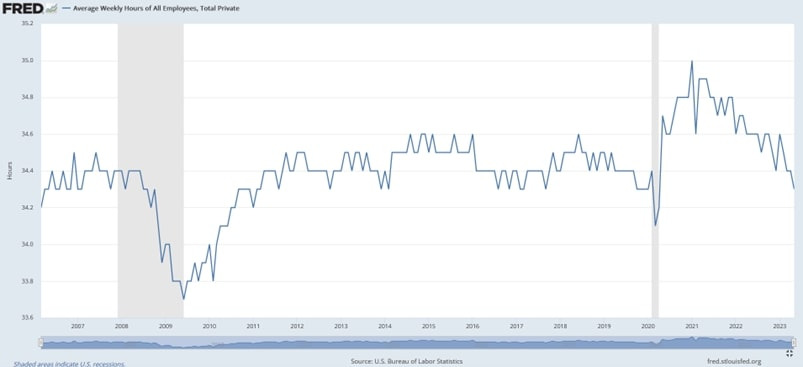

This was a slow week as the market is probably waiting for the next week’s US CPI report and the FOMC meeting. Nevertheless, we got some interesting developments on the macro side with big misses in a couple of US tier one data points, two surprising rate hikes and Eurozone entering a technical recession after revision to the previous data. The NFP report last Friday beat once again expectations on the headline number for the 14th consecutive time. Looking at the other parts of the report though…

The Impact on Me:

As an individual investor, the market movements of June 5-9, 2023, could have various effects on my portfolio and investment decisions. With big misses in US data points and surprising rate hikes, it is important for me to closely monitor these developments and adjust my investment strategy accordingly. The market waiting for the US CPI report and FOMC meeting suggests that there may be volatility ahead, and I need to be prepared for any potential fluctuations in the market.

The Impact on the World:

The macroeconomic developments during June 5-9, 2023, such as the Eurozone entering a technical recession and the NFP report beating expectations, have broader implications for the global economy. These market movements could influence international trade, investment decisions, and overall economic stability. It is essential for policymakers and investors around the world to pay close attention to these events and collaborate on strategies to mitigate any potential negative impacts.

Conclusion:

In conclusion, the trading week of June 5-9, 2023, brought about significant market movements and macroeconomic developments that have implications for both individual investors and the global economy. It is crucial to stay informed, analyze the data carefully, and make informed decisions to navigate through potential volatility and capitalize on investment opportunities in this ever-changing landscape.