The Rise of Institutional Forex Trading Demand in May

The Monthly Spot Trading Volume Rebound

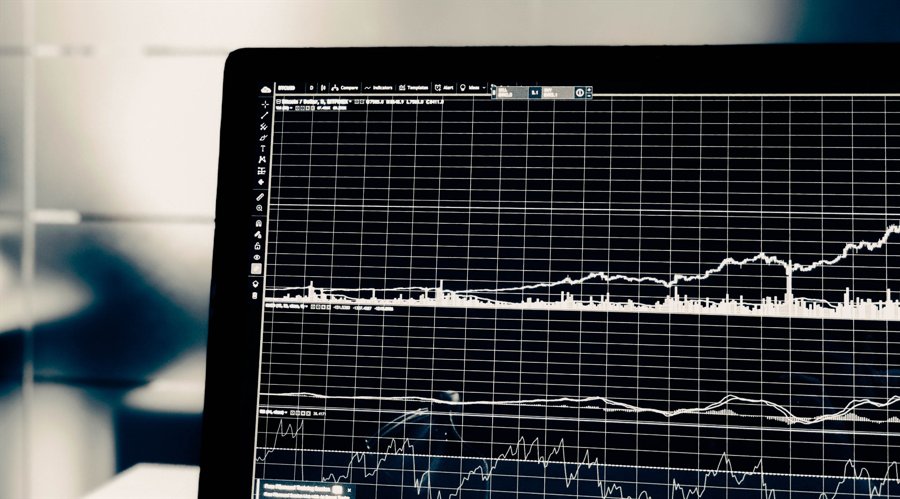

May was a promising month for the institutional forex trading market as the demand for spot trading volume saw a significant rebound. The latest figures from Cboe FX Markets and Deutsche Börse’s 360T show a noticeable uptick in trading activity, indicating a positive trend for the industry.

A Monthly Uptick in Spot FX Volumes

According to the official numbers, Cboe FX Markets handled $938.9 billion in total spot trading volume in May, marking an increase of more than 18.2 percent from the previous month. This surge in trading volume is a clear indication of the improving market conditions and renewed interest in forex trading among institutional investors.

Similarly, Deutsche Börse’s 360T also recorded a significant jump in spot trading volume, with a 7.8 percent increase from the previous month. This growth reaffirms the positive sentiment in the market and highlights the resilience of the forex trading industry in the face of economic uncertainties.

Overall, the recovery in institutional forex trading demand in May is a promising sign for the market, indicating a renewed confidence among investors and a potentially lucrative period ahead for forex traders.

How This Will Affect Me

As an individual investor, the rise in institutional forex trading demand can have a positive impact on your trading activities. The increased trading volume and market activity can lead to improved liquidity, tighter spreads, and potentially more trading opportunities for retail traders. This could result in better pricing and execution for your trades, ultimately benefiting your investment portfolio.

How This Will Affect the World

The recovery in institutional forex trading demand is not only good news for individual investors but also for the global economy as a whole. The forex market plays a crucial role in facilitating international trade and investment, and increased trading activity signifies growing confidence in the global economy. This positive trend can stimulate economic growth, encourage cross-border investments, and contribute to overall market stability.

Conclusion

The rise in institutional forex trading demand in May bodes well for the market, signaling a return to positive momentum and heightened trading activity. As individual investors, we can look forward to a more dynamic and liquid market environment, while the global economy stands to benefit from increased investment and trade opportunities. The future looks bright for the forex market, and we can expect continued growth and stability in the coming months.