Two Economists Predict Aggressive Cash Rate Hikes from RBA

Credit Suisse equity strategist predicts cash rate to reach 4.6% by September

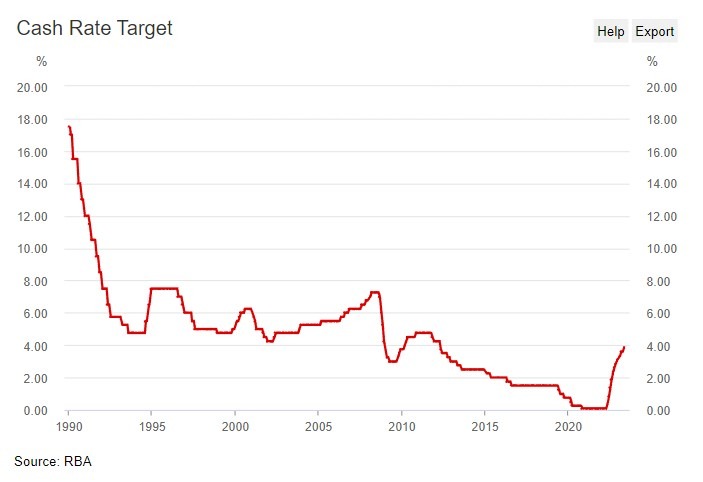

According to Bloomberg, two economists are expecting the Reserve Bank of Australia (RBA) to continue with aggressive cash rate hikes in the upcoming months. Credit Suisse’s Yaying Dong believes that the cash rate could reach 4.6% by September, citing the rise in services inflation as a key driver. Dong states, “Our models suggest that core inflation is just going to take a much longer time to return back to the target unless the RBA were to raise rates more aggressively.”

With services inflation becoming more entrenched, Dong’s forecast points towards a sustained period of rate increases by the RBA. Despite this, he highlights that there are still plenty of growth drivers in the economy that could support a higher cash rate environment. Dong’s prediction aligns with the views of another economist mentioned in the Bloomberg article, who also anticipates further rate hikes from the RBA.

Effects on Individuals

For individuals, the potential increase in cash rates could mean higher borrowing costs, particularly for those with variable rate mortgages or personal loans. Savers may benefit from higher interest rates on their savings accounts, but overall, the increased cost of borrowing could put pressure on household budgets.

Global Impact

The RBA’s decision to raise cash rates could also have implications for the global economy. A higher cash rate in Australia may attract foreign investment, strengthening the Australian dollar and impacting the country’s export competitiveness. Additionally, changes in Australia’s monetary policy could influence global interest rates and investor sentiment, leading to broader economic implications.

Conclusion

As economists predict continued aggressive cash rate hikes from the RBA, individuals and the global economy could feel the effects of these policy decisions. While higher interest rates may bring challenges for borrowers, they also signal confidence in Australia’s economic recovery and could have widespread implications for financial markets worldwide.