Mastering Stock Analysis: 3 Essential Metrics You Need to Know

Introduction

Success in the investment game is all about knowing what data to look at and how to interpret it. Making informed decisions based on accurate analysis is key to maximizing profits and minimizing risks in the stock market.

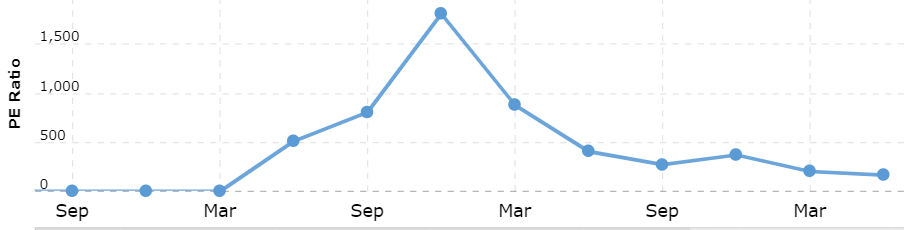

Price/Earnings Ratio

The price/earnings ratio, also known as P/E ratio, is a fundamental metric for evaluating the relative value of a stock. It is calculated by dividing the current price of the stock by its earnings per share. A high P/E ratio may indicate that a stock is overvalued, while a low P/E ratio may suggest it is undervalued. Understanding this ratio can help investors determine whether a stock is worth investing in.

Free Cash Flow

Free cash flow is a measure of a company’s financial performance and health. It represents the cash a company generates after accounting for capital expenditures. Positive free cash flow indicates that a company has enough cash to cover its expenses and invest in future growth. Investors use this metric to assess a company’s ability to generate returns and manage its financial obligations.

Debt/Equity Ratio

The debt/equity ratio is a financial leverage ratio that compares a company’s total debt to its shareholders’ equity. It indicates how much debt a company is using to finance its operations compared to its equity. A high debt/equity ratio may be a sign of financial risk, as it suggests the company is relying heavily on borrowed funds. Investors use this ratio to assess a company’s financial stability and risk level.

Effect on Individuals

Understanding these essential stock analysis metrics can empower individual investors to make better-informed decisions when buying or selling stocks. By analyzing the P/E ratio, free cash flow, and debt/equity ratio of a company, investors can assess its financial health and growth potential, ultimately leading to more profitable investment outcomes.

Effect on the World

Mastering stock analysis and using key metrics like the P/E ratio, free cash flow, and debt/equity ratio can have a broader impact on the world economy. By making sound investment decisions based on accurate analysis, investors contribute to market efficiency and stability. Companies with strong financial fundamentals are more likely to attract investment, fueling economic growth and innovation.

Conclusion

Learning to analyze stocks with these 3 essential metrics is a valuable skill that can help investors navigate the volatile world of the stock market. By understanding the price/earnings ratio, free cash flow, and debt/equity ratio, individuals can make well-informed investment decisions that lead to financial success. Mastering stock analysis is the key to unlocking the full potential of your investment portfolio.