The Impact of Inflation Data on the Economy

Understanding the Recent Inflation Numbers

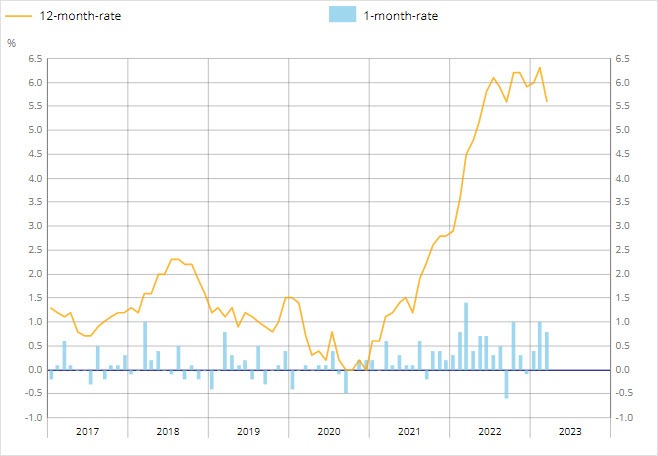

The latest inflation data released showed a mixed picture, with some indicators coming in above expectations and others below. The Consumer Price Index (CPI) rose by 0.8% compared to the expected 0.9%, but was still significantly higher than the previous month’s figure of 0.1%. On the other hand, the Harmonized Index of Consumer Prices (HICP) came in at 6.6% year-on-year, slightly above the expected 6.5%. The monthly HICP reading also exceeded expectations, with a 0.9% increase compared to the forecasted 0.8%.

Impact on the European Central Bank

As mentioned yesterday, the fall in annual headline inflation owes much to base effects but the monthly reading continues to show an increase in price pressures. That will keep the ECB on their toes with core inflation also still holding at the highs. The central bank will need to carefully monitor these developments and consider how they may affect their monetary policy decisions going forward.

How Will This Affect Me?

For consumers, higher inflation means that the cost of goods and services will likely continue to rise. This could put a strain on household budgets and reduce purchasing power. It may also impact savings and investments, as the real value of money decreases with inflation.

Global Implications

The rise in inflation in Europe may have broader implications for the global economy. Higher prices in the eurozone could lead to increased costs for imported goods, affecting trade flows and potentially leading to higher inflation in other parts of the world.

Conclusion

Inflation data plays a crucial role in shaping economic policy and impacting individuals and businesses around the world. As price pressures continue to rise, it is essential for policymakers to carefully consider the implications and take appropriate action to ensure stability and sustainable growth.