The Impact of Positive US Data on USD/JPY Outlook

Market Anticipation of Fed Interest Rate Increases

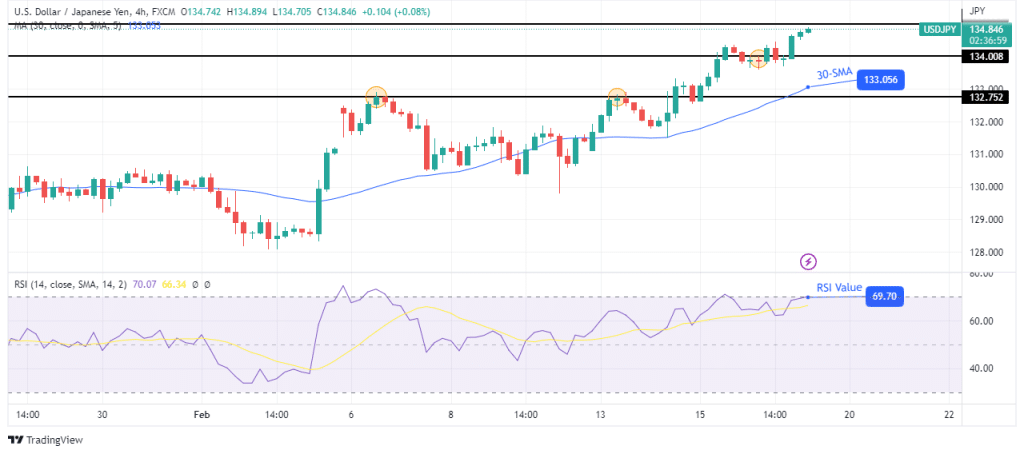

The market anticipates additional interest rate increases from the Fed. Initial jobless claims in the US surprisingly decreased last week. Japan’s export growth slowed significantly in January. Today’s USD/JPY outlook is bullish. The dollar soared on Friday, reaching a six-week high. The market anticipated additional interest rate increases in response to strong economic data.

Positive US Data Points to Additional Fed Hikes

With the recent positive data coming out of the US economy, especially the decrease in jobless claims, investors are now expecting the Federal Reserve to continue raising interest rates in the near future. This has led to a bullish outlook on the USD/JPY pair, as the US dollar has strengthened against the Japanese yen.

This increase in interest rates by the Fed is a reflection of the strong economic performance of the US, which has been fueled by robust consumer spending, low unemployment rates, and steady economic growth. The market is responding positively to this data, with the dollar gaining ground against other major currencies.

Overall, the outlook for the USD/JPY pair remains positive as long as the US economy continues to show signs of strength and the Federal Reserve maintains its current monetary policy stance.

Effects on Me

As a consumer and investor, the positive US data and the anticipated interest rate hikes by the Fed will have both direct and indirect effects on me. The stronger US economy may lead to higher interest rates on loans and mortgages, which could impact my personal finances. On the other hand, a stronger dollar could make imported goods cheaper, benefiting me as a consumer.

Effects on the World

The positive US data and the potential interest rate increases by the Fed will have ripple effects on the global economy. A stronger US dollar could impact international trade and exchange rates, affecting countries that rely heavily on exports to the US. Additionally, higher interest rates in the US could attract foreign investors, leading to capital flows and potentially impacting emerging markets.

Conclusion

In conclusion, the positive US data and the anticipated interest rate hikes by the Federal Reserve have led to a bullish outlook on the USD/JPY pair. The strong US economy and the potential for higher interest rates have implications for both individual consumers and the global economy. It will be important to monitor these developments closely to assess the full extent of their impact.