Dallas Fed Manufacturing Index for January

Overview

The Dallas Fed manufacturing index for January came in at -8.4, a significant improvement from the previous month’s revised figure of -20. This indicates a less severe contraction in manufacturing activity in the region. Let’s take a closer look at some of the key components of the report:

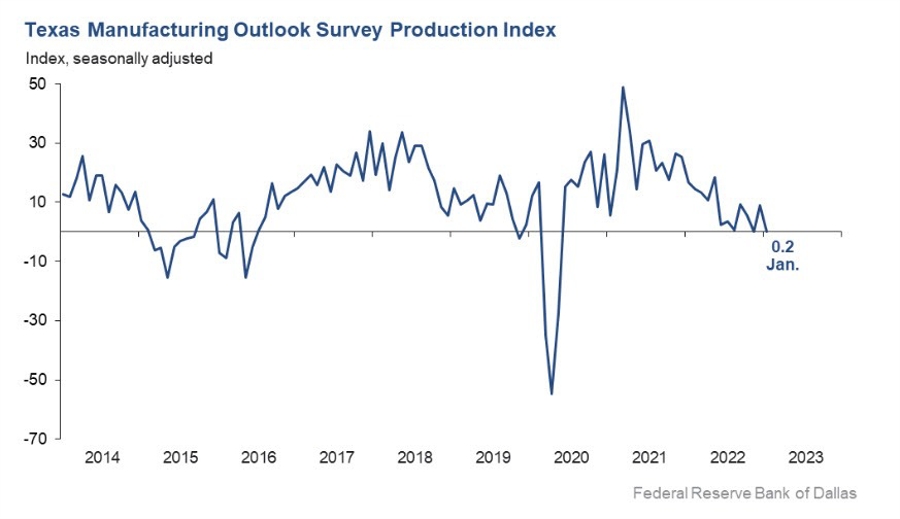

Production Index

The production index dropped to 0.2 in January, down from 9.1 in December. This suggests a slowdown in manufacturing output for the month.

New Orders Index

The new orders index remained negative for the eighth consecutive month, indicating a continued decrease in demand. However, it did show a slight improvement, moving up from -11.0 to -4.0.

Growth Rate of Orders

The growth rate of orders also declined to -12.3 from -9.3 last month, signaling a further slowdown in new orders for manufacturers in the Dallas region.

Employment

The employment index saw a slight increase to 17.6 from 13.6 last month, suggesting some growth in hiring activity in the sector.

Hours Worked

On the flip side, the hours worked index decreased to 3.8 from 5.6 last month, indicating a decrease in the amount of hours worked by employees in the manufacturing sector.

Capital Expenditures

The capital expenditures index came in at 11.6, showing a slight improvement from the previous month’s figure. This suggests that manufacturers in the region are continuing to invest in equipment and technology.

Overall, while the Dallas Fed manufacturing index remains in negative territory, there are signs of stabilization and even slight improvement in some key indicators. The trajectory of the index will be important to monitor in the coming months to gauge the health of the manufacturing sector in the region.

How This Will Affect Me

As a resident of the Dallas region, the performance of the manufacturing sector can have a direct impact on job opportunities, economic growth, and overall prosperity. A rebound in manufacturing activity could lead to increased job creation, higher wages, and a boost in consumer confidence. On the other hand, a prolonged contraction in the sector could result in job losses, reduced spending power, and a slower pace of economic growth.

How This Will Affect the World

The performance of the manufacturing sector in Dallas can also have broader implications for the national and global economy. Given the interconnected nature of supply chains and trade networks, a significant downturn in the region’s manufacturing output could ripple through to other industries and countries. It could also impact commodity prices, stock markets, and exchange rates, influencing the overall stability of the global economy.

Conclusion

The latest Dallas Fed manufacturing index for January shows signs of improvement in some key indicators, suggesting a potential stabilization in the sector. While challenges remain, such as the negative growth rate of new orders and the decrease in hours worked, the slight uptick in employment and capital expenditures points to cautious optimism. Continued monitoring of the index will be crucial to assess the trajectory of the manufacturing sector in the region and its broader impact on the economy.