It’s All Quiet on the Expiry Front

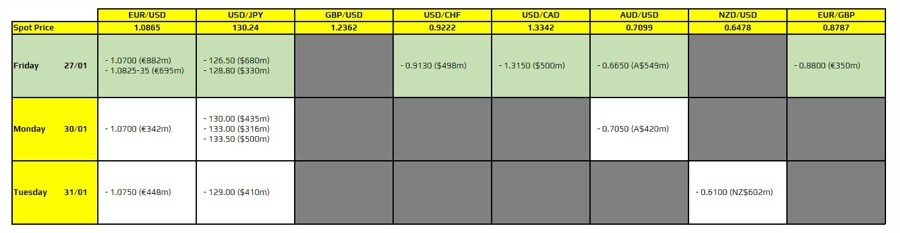

There aren’t any major expiries to take note of for today and I’ve also included the ones for month-end next week as well. Looking through, there aren’t any significant ones to wrap up January either. As such, trading sentiment will revolve around the risk mood mostly but we might see a bit of a lull ahead of the FOMC meeting next week.

That said, month-end flows might factor into the equation and provide some volatility to the market. It’s always interesting to see how these flows play out and if they will impact market direction in any significant way. As always, it’s best to keep an eye on the news and economic indicators to gauge where things might be headed.

How Will This Affect Me?

For individual traders and investors, the lack of major expiries means that there may not be any specific catalysts to watch out for in the short term. This could result in a more subdued trading environment and potentially lower volatility levels. It might be a good time to reassess your trading strategy and consider any changes you may need to make in light of the current market conditions.

How Will This Affect the World?

On a larger scale, the lack of significant expiries could mean that global markets may be in a holding pattern until the next major event or economic data release. This could have a ripple effect on other markets and economies, as trading sentiment is influenced by the overall lack of direction in the market. It’s a reminder of how interconnected the global economy is and how one seemingly small factor can have widespread implications.

Conclusion

In conclusion, while there may not be any major expiries to watch out for at the moment, it’s important to stay alert and prepared for any unexpected developments in the market. Remember to do your research, stay informed, and be ready to adapt to changing market conditions. Happy trading!