The Impact of Option Expiries on Trading Sentiment

Understanding the Influence of Option Contracts

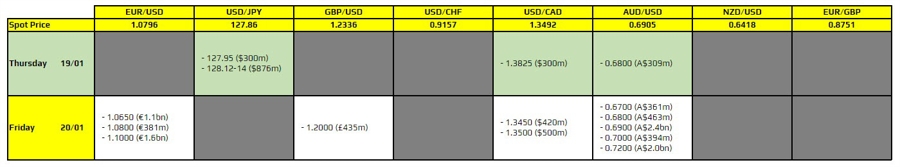

Once again, there aren’t any major expiries for today. As such, trading sentiment is likely to be dictated by the risk mood if anything else. But just be mindful that there might be some large ones for EUR/USD and AUD/USD that could factor into play tomorrow.

Option contracts play a significant role in the forex market, influencing trading sentiment and shaping price movements. Understanding how these expiries work is crucial for traders looking to navigate market volatility and make informed decisions.

For more information on how to use this data, you may refer to this post.

Impact on Individual Traders

As an individual trader, being aware of upcoming option expiries can help you anticipate potential market movements and adjust your trading strategy accordingly. Large expiries for major currency pairs like EUR/USD and AUD/USD can create increased volatility and opportunities for profit, but also pose risks if not managed effectively.

Global Implications

The impact of option expiries extends beyond individual traders to the global forex market, influencing overall trading sentiment and market liquidity. Large expiries can result in sharp price movements and heightened volatility, affecting currency exchange rates and investor confidence on a broader scale.

Conclusion

In conclusion, option expiries play a crucial role in shaping trading sentiment and driving market dynamics. By staying informed and understanding how these expiries can impact price movements, traders can make more strategic decisions and capitalize on market opportunities. Whether trading individually or contributing to the global market, being mindful of option expiries is essential for navigating the complexities of the forex market.