Is your wallet ready for higher interest rates?

A look into the potential rate hikes by the European Central Bank

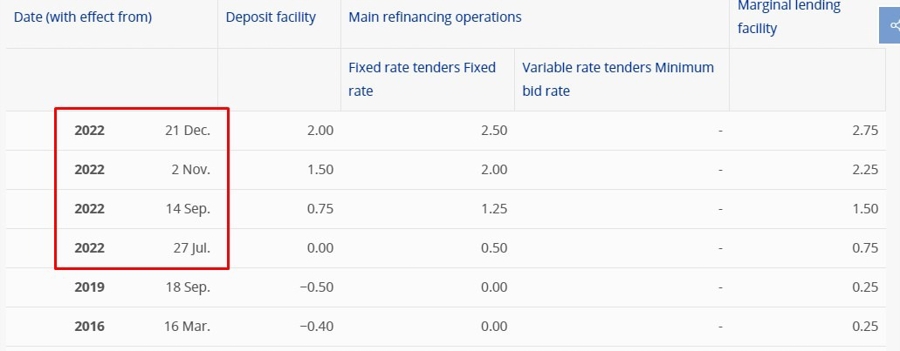

European Central Bank Governing Council member Martin Kazaks, who also serves as the governor of Latvia’s central bank, recently shared some insights during a phone interview with Bloomberg.

Bloomberg is gated, but we were able to gather some of Kazaks’ main points:

- “Currently I would see that at the February and March meetings we will have significant rate increases”

- “Of course the steps may become smaller as necessary as we find the level appropriate to bring the inflation down to 2%.”

Kazaks is considered to be on the more hawkish end of the European Central Bank’s spectrum, indicating a potential shift towards tighter monetary policy in the near future.

While these rate hikes may sound daunting, they are ultimately aimed at keeping inflation in check and maintaining a healthy economic environment. But what does this mean for you personally?

Implications for individuals:

As interest rates rise, borrowing costs are likely to increase. This could affect anything from mortgages to car loans to credit card debt. If you have variable interest rate loans, your monthly payments may go up as a result of the rate hikes. Savers, on the other hand, may benefit from higher returns on their savings and investment accounts.

Global impact:

The decisions made by the European Central Bank have far-reaching consequences beyond individual consumers. Changes in interest rates can influence currency exchange rates, stock markets, and overall economic growth. As one of the world’s major central banks, the European Central Bank plays a significant role in shaping the global economy.

Conclusion:

While the prospect of rate hikes may elicit some anxiety, it’s important to remember that these decisions are made with the goal of maintaining economic stability in mind. By staying informed and being proactive in managing your finances, you can navigate these changes with confidence.