Don’t Check Out Yet, Data is Coming!

Stay Tuned for US Economic Updates

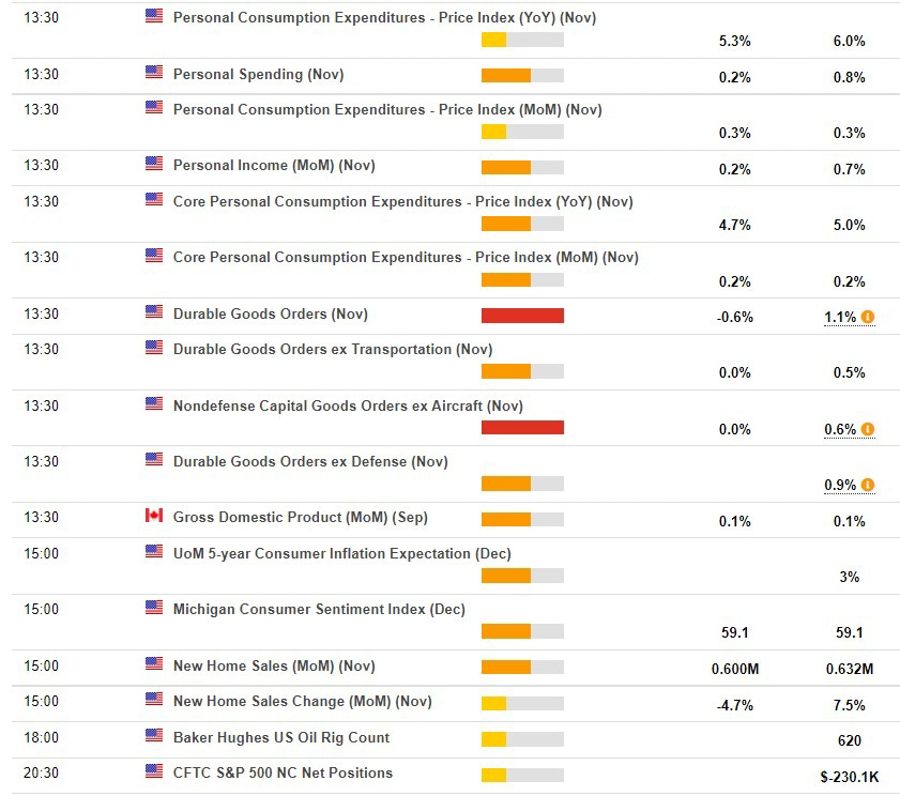

Don’t check out for the holidays just yet, there is a load of data coming from the US later today. Snippet previews via Scotia:

Scotia:

- In the wake of the soft CPI report for November, the Fed’s preferred measures of inflation are likely to record soft changes of about 0% to +0.1% on headline PCE and core PCE gauges.

CIBC:

- “The Fed’s preferred measure of prices, core PCE prices, could have risen more modestly on a monthly basis than its CPI counter…

With the upcoming US economic data releases, it’s important to stay informed about the potential impacts on the economy and financial markets. As the Federal Reserve closely monitors inflation indicators like the core PCE prices, any significant changes could influence their decision-making process regarding monetary policy.

How Will This Affect Me?

As a consumer, changes in inflation can impact your purchasing power and the overall cost of goods and services. If core PCE prices rise more modestly than expected, it could signal relatively stable inflation levels, potentially leading to more gradual adjustments in interest rates.

How Will This Affect the World?

The US economy plays a significant role in the global financial landscape, so any shifts in key economic indicators can have ripple effects around the world. If the US experiences softer inflation changes, it could influence international market trends and investor sentiment on a global scale.

Conclusion

Stay tuned for the US economic data updates and consider the potential implications for both your personal finances and the broader global economy. Being informed and proactive in response to changing economic conditions can help you navigate uncertain times with confidence.