S&P Global’s Dan Yergin Predicts Oil Prices to Hit $121 a Barrel in 2023

What’s Driving the Price Forecast?

S&P Global vice chairman Dan Yergin recently spoke with CNBC about his predictions for oil prices in 2023. Yergin’s base case scenario is $90 per barrel for Brent crude, but he also highlighted the potential for prices to skyrocket to $121 a barrel if certain conditions are met.

- Yergin believes that if China successfully recovers from the impact of Covid-19, it could create a surge in demand for oil, leading to a significant price increase.

- Conversely, in the event of a recession, Yergin warns that oil prices could plummet to around $70 per barrel.

Key Uncertainties to Watch

Yergin pointed out three major uncertainties that could impact the future of oil prices:

- The Federal Reserve’s monetary policy decisions

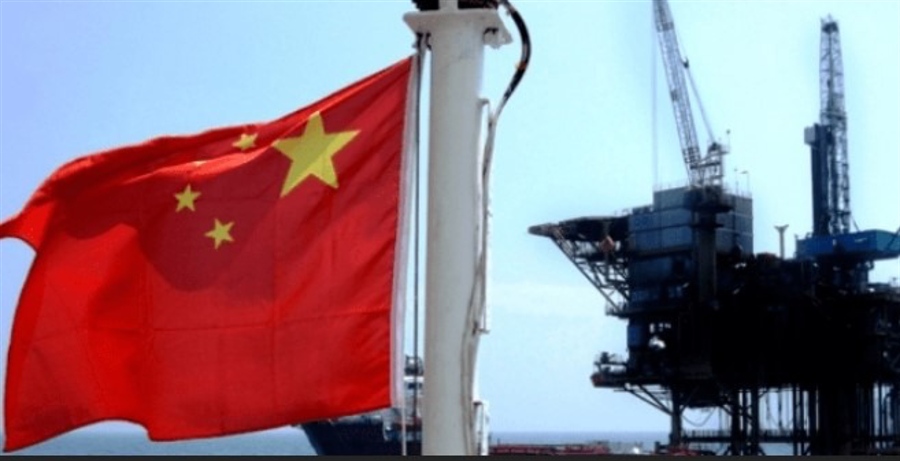

- China’s demand for oil

- Geopolitical tensions and their effects on global oil supply

Given these factors, it’s clear that the future of oil prices is far from certain and will depend on a variety of economic and geopolitical developments.

How Will This Forecast Affect Me?

As a consumer, the predicted increase in oil prices could lead to higher gasoline prices at the pump. This would mean that you may have to allocate more of your budget towards transportation costs, potentially impacting your overall spending habits.

How Will This Forecast Affect the World?

On a global scale, the fluctuations in oil prices can have far-reaching consequences. Higher oil prices could impact industries that rely heavily on oil, such as transportation and manufacturing, leading to increased production costs and potentially slowing down economic growth. Conversely, lower oil prices could provide a boost to consumer spending and economic activity in oil-importing countries.

Conclusion

With the uncertainty surrounding oil prices in 2023, it’s essential for individuals and businesses to stay informed and be prepared for potential fluctuations in the energy market. Keeping an eye on factors like the Federal Reserve’s policies and global demand for oil will be crucial in navigating the evolving landscape of oil prices.