The Impact of BOJ Decision on Monetary Policy

The BOJ decision earlier:

The recent announcement by the Bank of Japan (BOJ) revealed that the monetary policy would remain unchanged. This decision has sparked various discussions and speculations within the financial markets. Analysts have been closely monitoring the BOJ’s moves, trying to decipher the implications of this decision on the economy.

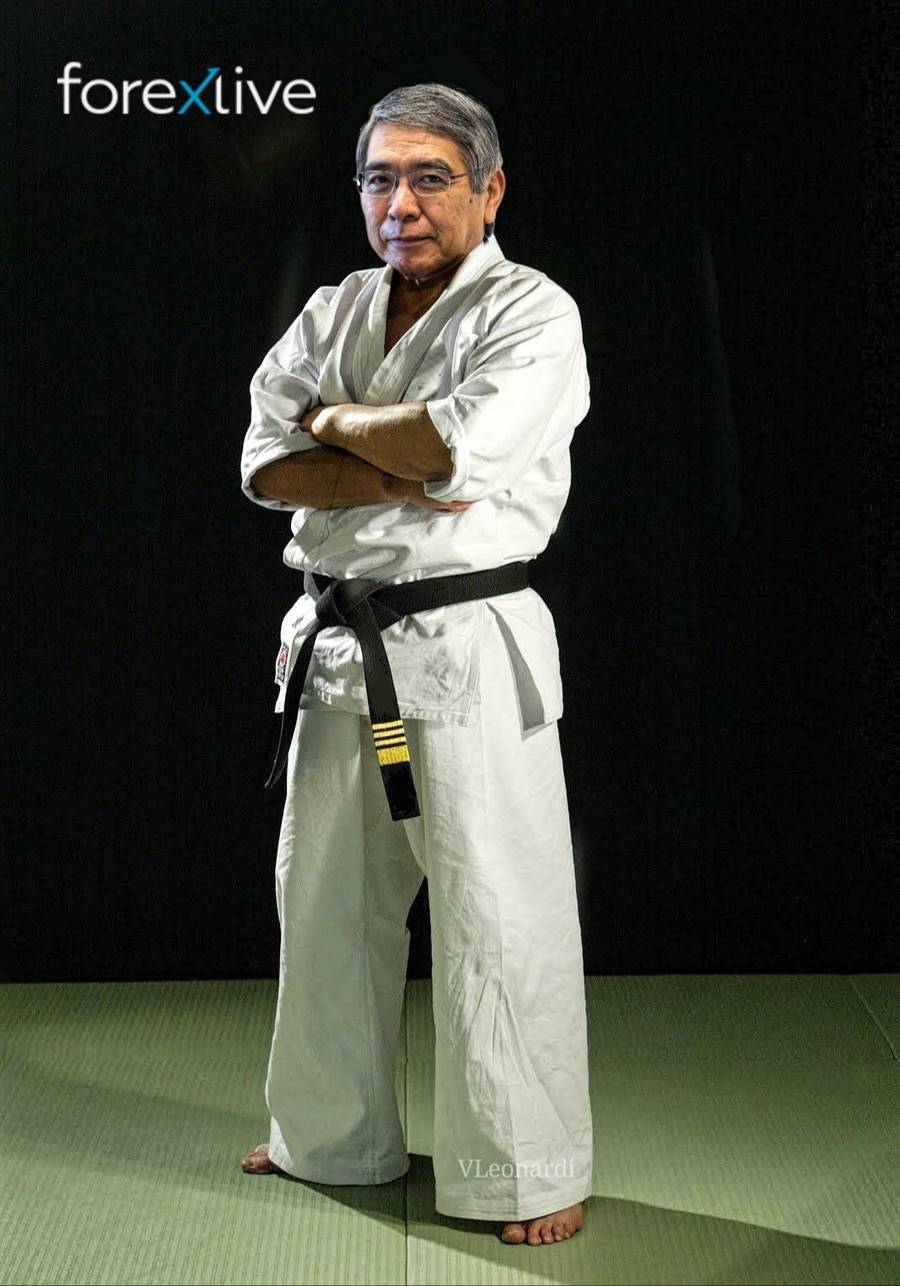

Kuroda, the Governor of the Bank of Japan, stated that the central bank would maintain its current stimulus measures to support the economy amidst the ongoing challenges. This decision comes at a crucial time when global economic uncertainties are looming, and central banks worldwide are adjusting their policies to navigate through the crisis.

Analysis of the BOJ decision:

The decision to leave the monetary policy unchanged indicates the BOJ’s cautious approach towards the economic recovery. By keeping the stimulus measures in place, the central bank aims to provide stability and support to the economy, particularly as inflation rates remain subdued and growth prospects are uncertain.

However, some analysts have pointed out that this decision may signal a minor crack in the BOJ’s resolve. With global economic conditions evolving rapidly, there is a growing pressure on central banks to adapt their policies accordingly. The BOJ’s decision to maintain the status quo raises questions about its capacity to respond effectively to the changing economic landscape.

Overall, the BOJ’s decision has sparked a mixed reaction among market participants, with some viewing it as a prudent move to ensure stability, while others see it as a missed opportunity to address emerging challenges.

Impact on Individuals:

The BOJ’s decision to keep the monetary policy unchanged may have a direct impact on individuals, particularly in terms of borrowing costs and savings rates. With interest rates remaining at low levels, borrowers may continue to benefit from affordable credit options. However, savers may experience lower returns on their investments, given the persistent low interest rates.

Impact on the World:

Internationally, the BOJ’s decision could have broader implications on the global economy. Japan’s economic policies often influence the strategies of other central banks and financial institutions worldwide. The BOJ’s stance on monetary policy could shape the overall market sentiment and impact trade relations between countries.

Conclusion:

In conclusion, the BOJ’s decision to leave the monetary policy unchanged reflects the central bank’s commitment to supporting economic stability. While the decision has raised some concerns about the BOJ’s flexibility, it also underscores the challenges faced by policymakers in navigating through uncertain times. The impact of this decision on individuals and the world economy remains to be seen, as global financial markets continue to adjust to evolving economic conditions.