Japan didn’t confirm intervention after unusually USD/JPY volatility

Introduction

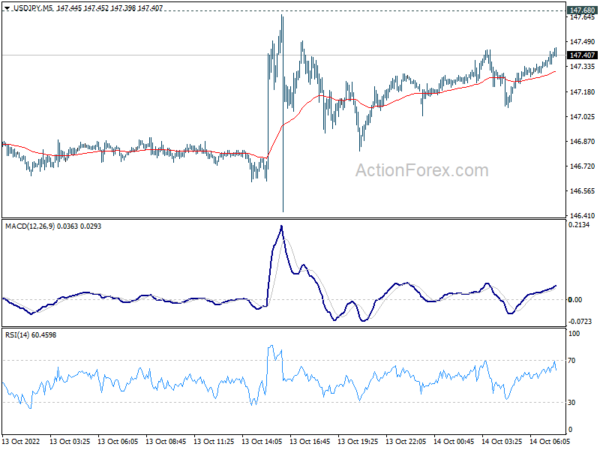

There was some unusual volatility in USD/JPY overnight as it approached the 1998 high at 147.68. The pair was knocked down but there was no sustained selling. Japan’s Ministry of Finance declined to confirm whether that was caused by intervention. Meanwhile, Finance Minister Shunichi Suzuki just reiterated the government’s readiness to take “appropriate action” against “excessive volatility.”

Analysis

The sudden fluctuation in the USD/JPY currency pair has raised eyebrows in the financial markets. Speculations abound about the potential reasons behind this volatility, with some attributing it to market manipulation or external factors. The lack of confirmation from Japan’s Ministry of Finance only adds fuel to the fire, leaving traders and investors on edge.

It is noteworthy that Finance Minister Shunichi Suzuki’s statement about taking “appropriate action” against “excessive volatility” hints at a possible intervention to stabilize the currency pair. However, the ambiguity surrounding the situation has created uncertainty, leading to further speculation and market jitters.

While interventions in the forex market are not uncommon, the lack of transparency in this case has fueled concerns about the government’s motives and the impact on the stability of the Japanese yen. Traders are closely monitoring the situation for any signs of further intervention or market manipulation.

Impact on Me

As an individual investor or trader, the unusual volatility in the USD/JPY currency pair could affect your investment decisions and trading strategies. The uncertainty surrounding the situation may lead to increased market volatility and risk, potentially impacting your portfolio’s performance.

Impact on the World

The lack of confirmation regarding intervention in the USD/JPY currency pair could have broader implications for the global financial markets. Uncertainty and speculation surrounding the situation could disrupt currency markets and create ripple effects across various asset classes, impacting investors and economies worldwide.

Conclusion

In conclusion, the unusual volatility in the USD/JPY currency pair and the lack of confirmation from Japan’s Ministry of Finance have raised concerns in the financial markets. The ambiguity surrounding the situation and the government’s readiness to take action against excessive volatility have created uncertainty among traders and investors. It remains to be seen how this situation will unfold and its potential impact on the global economy.