Market Events for the Week Ahead

MON

Norwegian CPI for September will be released, giving insights into the country’s inflation rate. Additionally, the Eurozone Sentix Index for August will be published, providing information on investor confidence in the region. Japan will also observe a holiday on Monday.

TUE

The UK Jobs Report for September will be a key focal point for investors, shedding light on the state of the labor market in the UK.

WED

Wednesday will see the first day of the G20 Meeting, bringing together leaders from the world’s largest economies to discuss key global issues. The Bank of Korea will also make an announcement, while the UK GDP for August, US PPI for September, and FOMC Minutes for September will be released. The Energy Information Administration (EIA) will publish the Short-Term Energy Outlook (STEO), and Hong Kong will observe a holiday.

THU

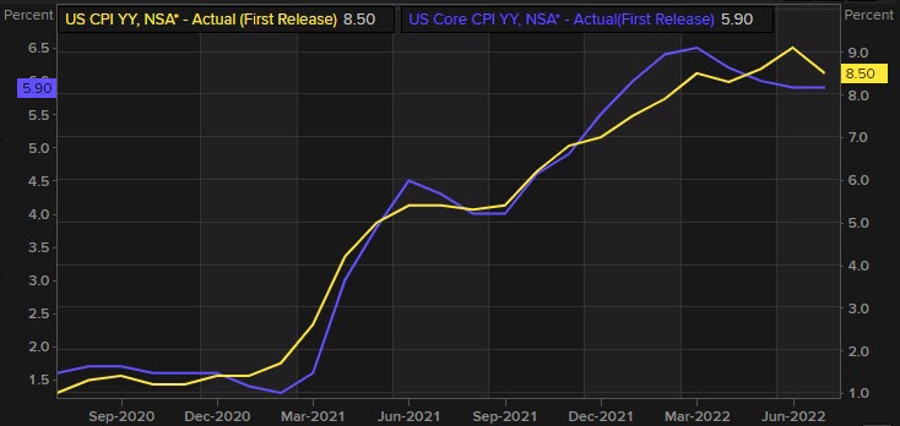

The second day of the G20 Meeting will take place on Thursday, with discussions continuing on global economic matters. Germany will release its Final CPI for September, Sweden will provide data on its CPI for the same month, and the US will publish its CPI figures for September.

FRI

Friday will see the release of important economic data from China, including Inflation and Trade Balance figures for September. India will also publish its Inflation data for the month. In the US, Retail…

What does this mean for me?

The release of key economic indicators such as CPI, PPI, and GDP data can have a direct impact on consumer prices, market sentiment, and monetary policy decisions. As an investor or consumer, it is important to stay informed about these events to make well-informed decisions.

How will this affect the world?

The outcomes of the G20 Meeting and the release of economic data from major economies like the UK, US, China, and Eurozone will have ripple effects across the global economy. Changes in inflation, trade balances, and economic growth can influence international trade relations, currency values, and overall market stability.

Conclusion

As we navigate through the week ahead, it is crucial to pay attention to the various economic events and data releases that can impact both individual financial decisions and the broader global economic landscape. Stay informed, stay prepared, and stay ahead in a dynamic and interconnected world.