The Importance of the 380 Strike in Option Flows

Exploring the Benzinga Option School’s Analysis

One of the main themes in the Benzinga Option School this week was how prominent the 380 strike was in terms of option flows. Our internal analytics showed how 380 is the largest strike by call + put gamma, indicating significant market interest and activity at this level.

Many traders and investors were closely watching the 380 strike as it continued to attract attention from both buyers and sellers. The data suggested that there was a strong possibility of significant price movement around this strike, leading to potential trading opportunities for those who could interpret the signals correctly.

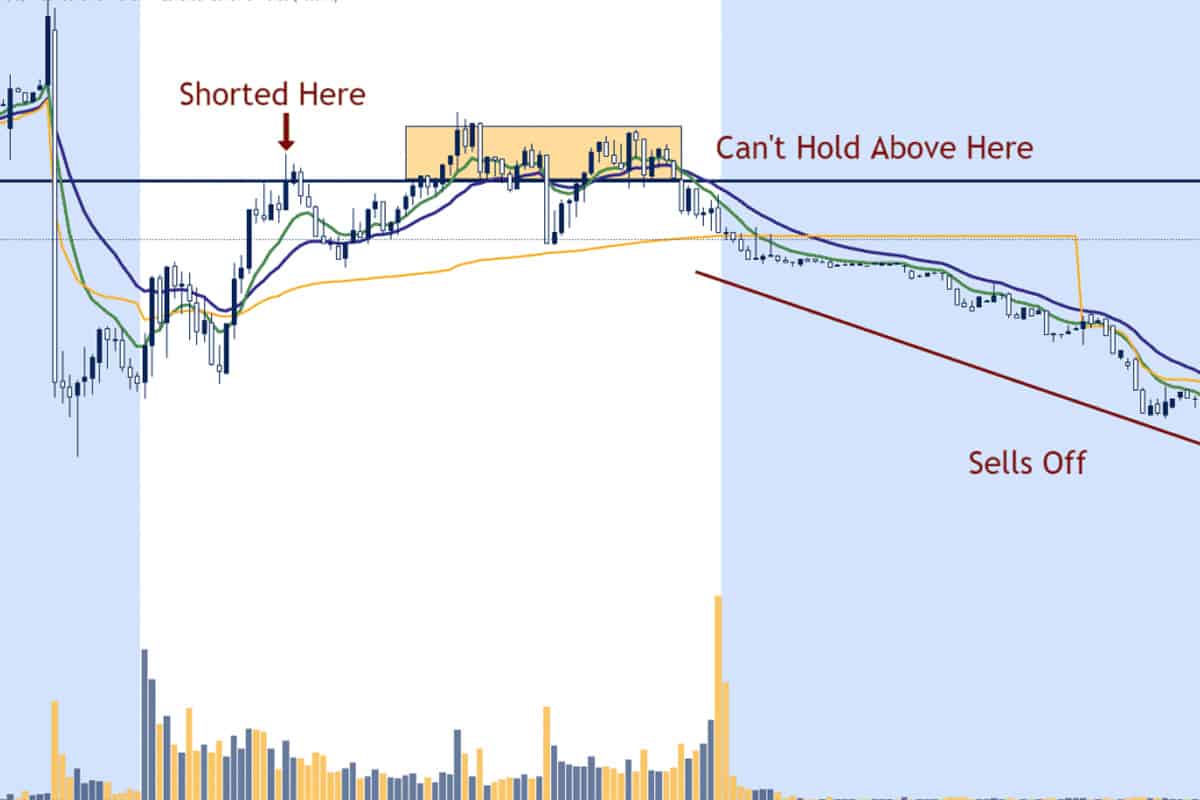

Selling the S&P 500 on Rallies Into Resistance

With the 380 strike in focus, some market participants were considering selling the S&P 500 on rallies into resistance. This strategy involved taking advantage of potential price reversals at key levels, such as the 380 strike, to profit from short-term market movements.

By analyzing the option flows and market dynamics, traders could make informed decisions about when to enter or exit trades based on the activity around the 380 strike. This approach required a deep understanding of market mechanics and the ability to interpret complex data accurately.

How This Analysis Will Impact Individuals

For individual traders and investors, staying informed about key levels like the 380 strike can provide valuable insights into market sentiment and potential price movements. By monitoring option flows and understanding the significance of certain strikes, individuals can make more informed trading decisions and potentially improve their overall performance in the market.

Those who are actively trading options may find the analysis of the 380 strike particularly useful in identifying potential trading opportunities and managing risk effectively. By incorporating this information into their trading strategies, individuals can adapt to changing market conditions and potentially capitalize on emerging trends.

How This Analysis Will Impact the World

On a broader scale, the analysis of the 380 strike and option flows can have implications for the wider financial markets. Market movements around key levels like the 380 strike can influence investor sentiment, market volatility, and overall economic conditions.

By understanding the significance of these levels and monitoring option flows, market participants, including institutions and policymakers, can gain valuable insights into market dynamics and make more informed decisions about their investments and risk management strategies. This can ultimately contribute to a more efficient and stable financial system.

Conclusion

In conclusion, the analysis of the 380 strike in option flows provides valuable insights into market sentiment and potential price movements. By understanding the significance of key levels like the 380 strike and monitoring option flows, individuals and institutions can make more informed decisions about their trading strategies and risk management practices. This analysis not only impacts individual traders and investors but also has broader implications for the wider financial markets and economy as a whole.