Charmingly eccentric, full of personality, and designed for maximum reader engagement

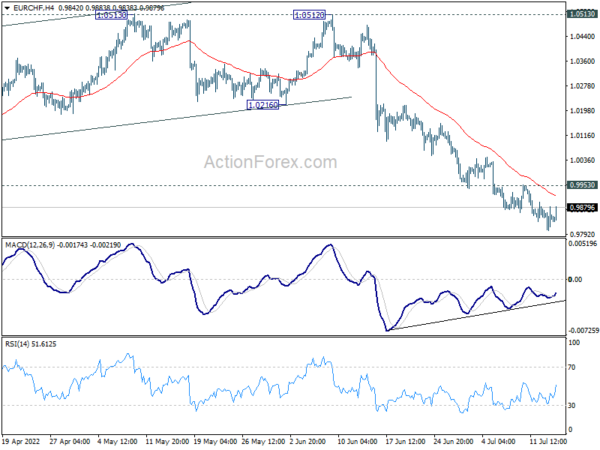

Daily Pivots: (S1) 0.9807; (P) 0.9846; (R1) 0.9884; More…

EUR/CHF is losing some downside momentum as seen in 4-hour MACD. But further decline is still possible.

As we delve into the world of forex trading and market analysis, we encounter daily pivots that serve as crucial reference points for traders. These pivots, calculated based on the previous day’s high, low, and close prices, help traders identify potential support and resistance levels for the current trading day.

Today’s pivot point for EUR/CHF stands at 0.9846, with key support at 0.9807 and resistance at 0.9884. The 4-hour MACD indicator suggests that the downward movement of EUR/CHF may be slowing down, indicating a possible reversal in the near future. However, it is important to note that further decline is still a possibility, and traders should exercise caution in their trading decisions.

Understanding and utilizing daily pivots can provide traders with valuable insights into market trends and potential price movements. By incorporating these reference points into their analysis, traders can make more informed decisions and improve their overall trading performance.

How will this affect me?

As a forex trader, being aware of daily pivots and market indicators like the 4-hour MACD can help you navigate the volatile forex market more effectively. By incorporating these tools into your trading strategy, you can make more informed decisions and potentially improve your trading performance.

How will this affect the world?

The fluctuation of currency pairs like EUR/CHF can have broader implications for the global economy. Changes in exchange rates can impact international trade, investment flows, and economic stability. By monitoring and analyzing market indicators like daily pivots, traders and policymakers can gain valuable insights into market trends and potential risks, helping to mitigate financial volatility on a global scale.

Conclusion

In conclusion, daily pivots and market indicators play a crucial role in shaping the world of forex trading and financial markets. By understanding and utilizing these tools effectively, traders can make more informed decisions and navigate the complexities of the global economy with greater confidence.