GBPUSD: A Financial Rollercoaster

The Rise and Fall of GBPUSD

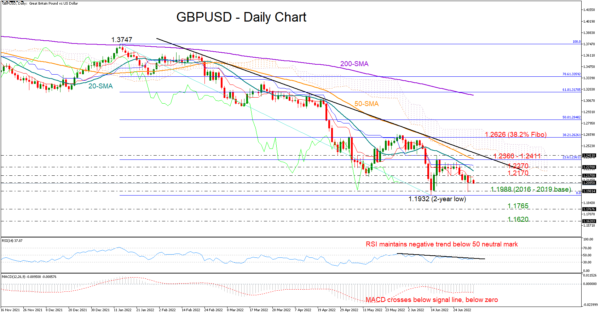

GBPUSD formed a tiny neutral candlestick on Monday above Friday’s closing price of 1.2087 and below the nearby 1.2170 resistance territory. The refusal…

The Impact on Me

As an individual investor, the fluctuations in the GBPUSD exchange rate can have a direct impact on my investments and financial decisions. A rise in the exchange rate could mean increased purchasing power for me when buying goods or services denominated in British pounds. However, a fall in the exchange rate could lead to decreased purchasing power and potential losses on investments tied to the pound.

The Global Impact

The GBPUSD exchange rate is closely watched by financial markets around the world due to the economic significance of both the British pound and the US dollar. A significant move in the exchange rate can have ripple effects on global trade, investment flows, and financial stability. For example, a sharp drop in the GBPUSD exchange rate could lead to increased volatility in the foreign exchange market and impact the competitiveness of British exports.

Conclusion

In conclusion, the GBPUSD exchange rate is a key indicator of market sentiment and economic conditions. As investors, it is important to stay informed about the latest developments and trends in order to make well-informed decisions. Whether you are an individual investor or a global financial institution, the GBPUSD exchange rate will continue to play a significant role in shaping the global economy.