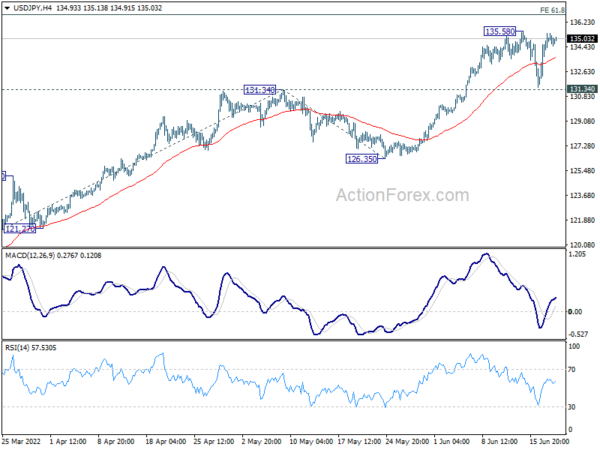

Daily Pivots: (S1) 132.98; (P) 134.20; (R1) 136.24; More…

Range Trading in USD/JPY Continues

Range trading in the USD/JPY pair persists as daily pivots indicate levels of support at 132.98, resistance at 136.24, and a central pivot point at 134.20. With this current scenario, the intraday bias for USD/JPY remains neutral initially, suggesting a period of consolidation in the market.

Market Analysis

The daily pivots provide traders with crucial levels to monitor as they determine potential points of reversal or continuation in the price action of USD/JPY. Traders can utilize these pivot points to make informed decisions on entry and exit points, as well as gauge the overall sentiment in the market.

Given the neutral bias in the short term, it is essential for traders to closely watch for any breakout or breakdown from the current range. A move above the resistance level at 136.24 could signal a bullish momentum, while a drop below the support level at 132.98 may indicate a bearish trend in the market.

Impact on Traders

Traders in the USD/JPY pair will need to adapt their strategies based on the current range-bound movement. By carefully monitoring price action around the pivot points, traders can capitalize on potential opportunities that arise from breakouts or reversals in the market.

Impact on the Global Economy

The USD/JPY pair is a widely traded currency pair that reflects the economic relationship between the United States and Japan. Any significant movement in this pair can have implications for global trade and investment flows, impacting not only the two countries involved but also other economies worldwide.

Conclusion

In conclusion, the daily pivots in the USD/JPY pair point to a period of range trading with a neutral bias. Traders must monitor the pivot points closely to identify potential opportunities in the market. The impact of this range-bound movement extends beyond individual traders, with implications for the global economy as a whole.