Is the USD/JPY Price Rally Coming to an End?

How Japan’s Response to the Yen’s Weakness Could Impact the Market

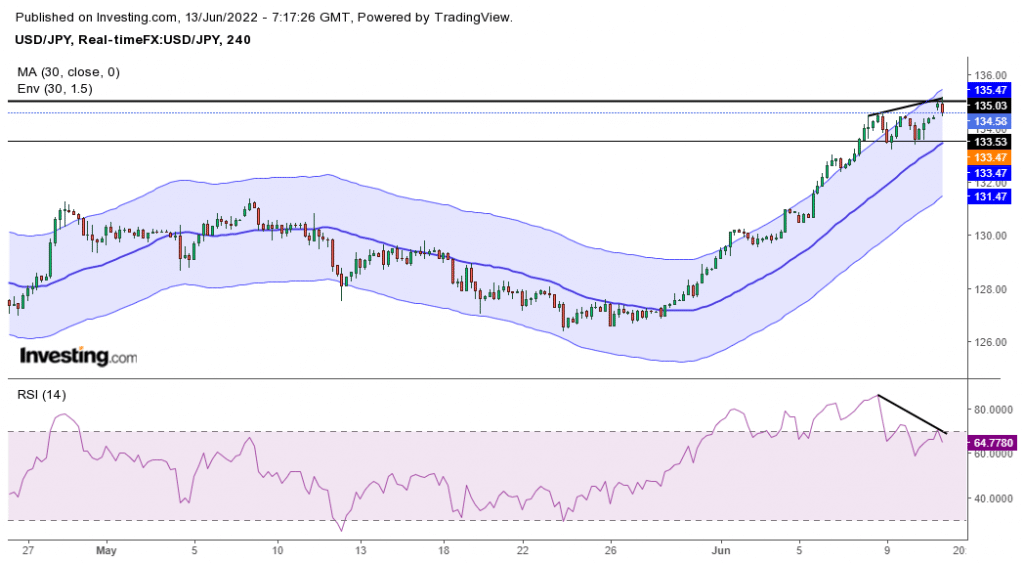

The USD/JPY has hit 135.00 for the first time in twenty years, fueling concerns over the yen’s weakness. Japan’s top officials are ready to “respond appropriately” to the situation, which has raised questions about the sustainability of the rally.

There are several factors contributing to the recent surge in the USD/JPY pair. One of the main drivers has been the Federal Reserve’s decision to taper its bond-buying program, which has bolstered the dollar. Additionally, the Bank of Japan’s loose monetary policy has weakened the yen, making the USD more attractive to investors.

However, there are growing concerns that the rally may be reaching its peak. Japan’s response to the yen’s weakness will be crucial in determining the future direction of the currency pair. If Japanese officials implement measures to strengthen the yen, such as intervention in the foreign exchange market, we could see a reversal in the USD/JPY’s upward trajectory.

Impact on Individuals

For individual investors, the potential end of the USD/JPY price rally could have both positive and negative consequences. Those who have invested in the USD could see a decrease in the value of their holdings if the dollar weakens against the yen. On the other hand, a stronger yen could benefit consumers by making imported goods cheaper.

Impact on the World

On a global scale, the USD/JPY price rally coming to an end could have far-reaching implications. A reversal in the currency pair’s trend could impact trade between the US and Japan, as a stronger yen would make Japanese exports more expensive for American consumers. This, in turn, could put pressure on Japanese exporters and slow down economic growth in the country.

Conclusion

The future of the USD/JPY price rally remains uncertain, as Japan’s response to the yen’s weakness will play a crucial role in determining the currency pair’s direction. Individual investors should keep a close eye on developments in the foreign exchange market and be prepared to adjust their portfolios accordingly. On a global scale, the impact of a potential end to the rally could have significant implications for trade and economic growth. It will be interesting to see how Japan’s actions in the coming months will influence the market.