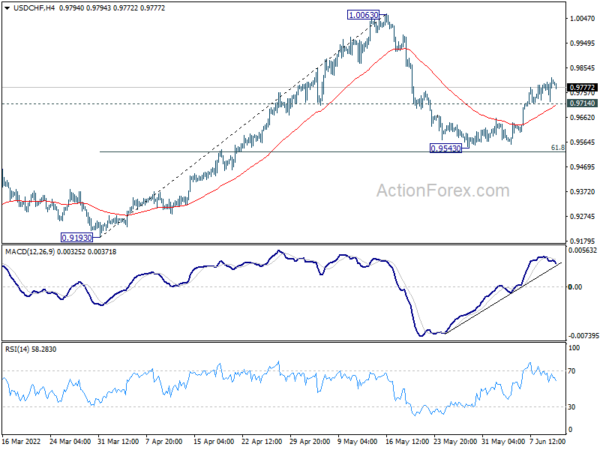

Daily Pivots: (S1) 0.9745; (P) 0.9781; (R1) 0.9839; More…

USD/CHF’s Rebound and Intraday Bias

USD/CHF has been experiencing a rebound from 0.9543, and this trend seems to be continuing after a brief consolidation. The intraday bias is now back on track…

As we delve into the world of forex trading, it’s important to understand the concept of daily pivots. These pivot points are calculated based on the previous day’s high, low, and close prices. They provide traders with potential support and resistance levels for the current trading day.

The daily pivots for USD/CHF currently stand at S1 0.9745, P 0.9781, and R1 0.9839. These levels can help traders make informed decisions about entry and exit points in their trading strategies.

USD/CHF’s rebound from 0.9543 signals a shift in market sentiment towards the US dollar. Traders are closely watching this development, as it could indicate further strength in the USD/CHF pair.

With the intraday bias back on track, traders are assessing the next potential moves in the market. Will USD/CHF continue its upward trajectory, or will we see a reversal in the coming days?

How Will This Affect Me?

As a forex trader, the daily pivots and intraday bias of USD/CHF can have a direct impact on your trading decisions. By staying informed about these key levels and trends, you can better navigate the market and potentially maximize your profits.

It’s important to analyze the current market conditions and adapt your trading strategy accordingly. Keep a close eye on USD/CHF’s price movements and be prepared to act swiftly based on the latest developments.

How Will This Affect the World?

While the daily pivots of USD/CHF may seem like a small piece of the global financial puzzle, they are indicative of broader market trends and sentiment towards the US dollar. A strong USD/CHF pair could reflect confidence in the US economy, impacting trade and investment decisions worldwide.

Traders and financial institutions around the globe are monitoring the movements of USD/CHF closely, as they can signal shifts in market dynamics and influence international trade relationships. The ripple effects of these changes can be felt across continents, shaping the global economic landscape.

Conclusion

As we witness USD/CHF’s rebound and intraday bias, it’s clear that the forex market is constantly evolving. By paying attention to daily pivots and market trends, traders can position themselves for success in this dynamic environment. Stay informed, stay adaptable, and stay ahead of the curve in your trading endeavors.