The Swiss National Bank Policy Decision Announcement

Introduction

The Swiss National Bank is set to announce its policy decision at 07:30 GMT on Thursday. This meeting has garnered a lot of attention from investors and the financial markets as it is considered to be a crucial event that could have significant implications for the Swiss economy as well as global markets.

Market Expectations

Market pricing currently implies a 70% probability of a policy change by the Swiss National Bank. This has resulted in heightened speculation and volatility in the Swiss Franc and Swiss equities leading up to the announcement.

Potential Impact

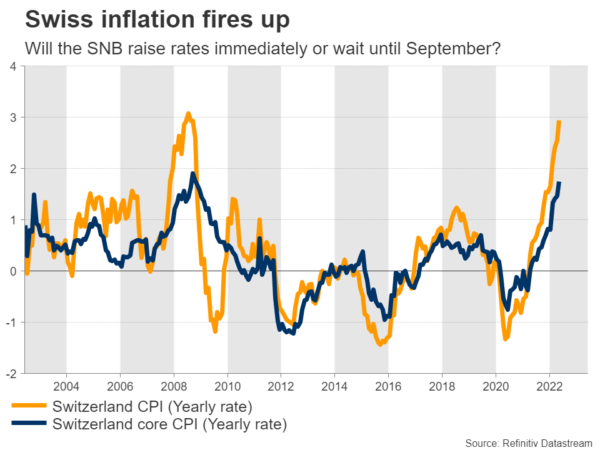

If the Swiss National Bank does decide to change its policy, it could have wide-ranging effects on various sectors of the Swiss economy. A potential interest rate hike could strengthen the Swiss Franc but hurt exporters, while a rate cut could boost economic growth but lead to inflation concerns.

Furthermore, any changes in the SNB’s policy could also have ripple effects on global markets. The Swiss Franc is considered a safe-haven currency, so any fluctuations in its value could impact foreign exchange markets and investor sentiment worldwide.

Conclusion

Overall, the upcoming policy decision by the Swiss National Bank is a critical event that investors and market participants will be closely watching. The outcome of this meeting could have far-reaching implications for both the Swiss economy and global financial markets. It is important to stay informed and prepared for any potential market movements resulting from the SNB’s decision.

Effects on Me

The Swiss National Bank’s policy decision could impact me directly if I have investments in Swiss assets or if I frequently engage in currency trading involving the Swiss Franc. Any changes in interest rates or monetary policy could affect the value of my investments and overall financial stability.

Effects on the World

As a global financial hub, Switzerland holds significant influence on international markets. Any policy changes by the Swiss National Bank could have spillover effects on other countries and currencies, leading to increased volatility in global financial markets. It is important for market participants worldwide to monitor the SNB’s decision and be prepared for any potential repercussions.