The Bearish On-Chain Metrics of XRP: A Detailed Analysis

The cryptocurrency market is a rollercoaster ride, and XRP, the fourth-largest digital asset, has not been an exception. After slipping to a 3-month low, XRP has witnessed bearish on-chain metrics that could indicate further price declines. Let’s delve deeper into this topic.

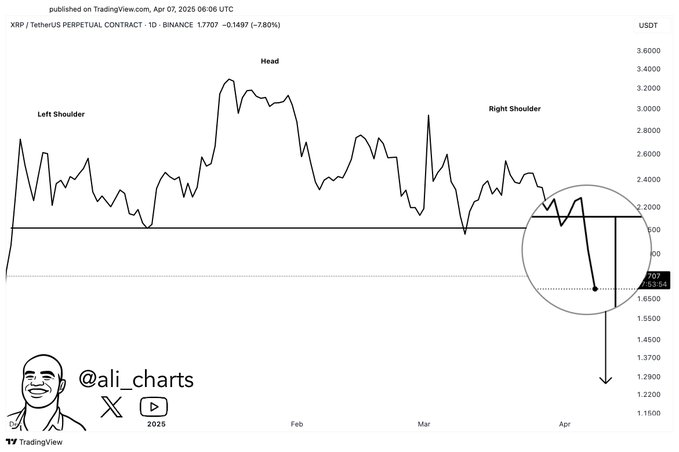

XRP’s Price Slip Below $2: A Psychological Barrier

XRP’s price drop below the $2 psychological barrier was a significant event that spooked investors. This price level has acted as a support in the past, and its breach could signal a bearish trend. The psychological impact of such a price movement cannot be underestimated, as it often leads to a wave of sell-offs.

Bearish On-Chain Metrics: A Closer Look

On-chain metrics are essential indicators of the health and activity of a cryptocurrency network. In the case of XRP, recent data suggests bearish trends. Here’s a closer look:

1. Whale Transactions

Large transactions, also known as whale transactions, can significantly impact the price of a cryptocurrency. In the case of XRP, the number of whale transactions has been increasing, indicating that large investors are selling their holdings. This selling pressure can lead to further price declines.

2. Network Activity

Another on-chain metric to consider is network activity. The number of active addresses and transactions on the XRP network has been decreasing, indicating a lack of interest from investors. This lack of activity can lead to a decrease in buying pressure and further price declines.

3. HODLers and Short-Term Investors

The distribution of XRP holdings between HODLers and short-term investors is also a crucial on-chain metric. Recent data suggests that a significant portion of XRP holdings is being held by short-term investors. This could indicate a lack of commitment from investors and further selling pressure during market downturns.

Impact on Individuals and the World

The bearish on-chain metrics of XRP could have a significant impact on individuals and the world. Here’s a closer look:

Impact on Individuals

For individual investors, the bearish on-chain metrics of XRP could mean further price declines and potential losses. It’s essential to keep a close eye on the market and adjust investment strategies accordingly.

Impact on the World

The impact of XRP’s bearish on-chain metrics on the world could be significant, particularly in the realm of cross-border payments and financial institutions. XRP is often used for these purposes due to its fast and low-cost transactions. However, if the price continues to decline, the adoption rate could slow down, impacting the growth of the Ripple network and its partnerships.

Conclusion

The bearish on-chain metrics of XRP are a cause for concern for individual investors and the world. The price decline below the psychological $2 barrier and the increasing number of whale transactions, decreasing network activity, and the lack of commitment from investors all point to a bearish trend. It’s essential to keep a close eye on the market and adjust investment strategies accordingly. However, it’s also important to remember that the cryptocurrency market is volatile, and prices can change rapidly. Stay informed and stay calm.

- Keep a close eye on XRP’s on-chain metrics

- Adjust investment strategies accordingly

- Stay informed about market trends

- Remember that the cryptocurrency market is volatile