Stock Markets Rebound and Bitcoin Surges: A New Era of Financial Growth

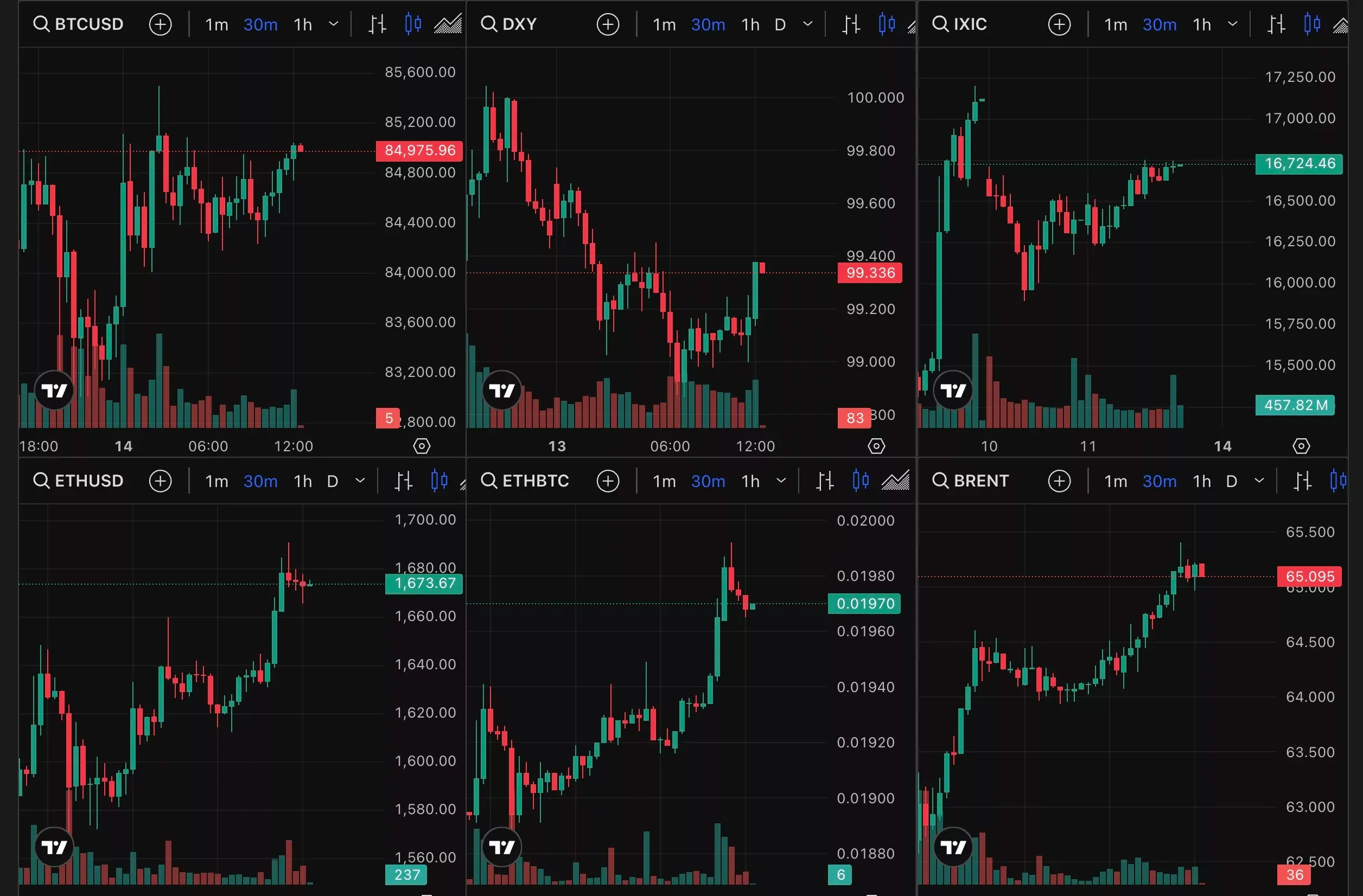

The financial markets have experienced a breathtaking turnaround in recent days, with the Nasdaq Composite Index inching closer to the 15,000 mark, representing nearly a 2% gain. This rebound comes after a tumultuous spring season that saw the index plummet due to various economic and geopolitical factors.

Nasdaq’s Recovery

The Nasdaq’s resurgence can be attributed to a number of positive factors. One of the most significant is the Federal Reserve’s decision to keep interest rates steady. This move has encouraged investors to pour money back into the stock market, particularly in tech stocks, which have been strong performers in recent years.

Bitcoin’s Remarkable Rise

Meanwhile, the cryptocurrency market has been witnessing its own remarkable surge. Bitcoin, the largest and most well-known cryptocurrency, reached an all-time high of over $85,000 earlier today. This surge can be attributed to a number of factors, including increasing institutional investment, growing mainstream acceptance, and a general sense of optimism about the future of the digital currency.

Impact on Individuals

For individual investors, this market trend presents both opportunities and challenges. On the one hand, those who have invested in tech stocks or cryptocurrencies have seen their portfolios grow significantly in value. On the other hand, those who have been hesitant to enter the market may feel overwhelmed or unsure about how to proceed.

- For those who have already invested, it may be wise to consider diversifying their portfolios to mitigate risk.

- Those who are new to investing may want to consider seeking advice from a financial advisor before making any major decisions.

- It’s important to remember that all investments come with risk, and it’s essential to do thorough research before making any investment decisions.

Impact on the World

The rebounding stock market and surging cryptocurrency prices have far-reaching implications for the global economy. Here are just a few:

- Increased economic growth: As investors pour money into the stock market and cryptocurrencies, businesses are likely to see increased revenue and profits, leading to economic growth.

- Increased innovation: The tech sector, in particular, is known for driving innovation and creating new industries. As tech stocks continue to perform well, we can expect to see even more groundbreaking innovations.

- Increased financial inclusion: Cryptocurrencies have the potential to bring financial services to billions of people around the world who are currently unbanked or underbanked. This could lead to significant economic development in developing countries.

Conclusion

The recent market trends, with the Nasdaq’s rebound and Bitcoin’s surge, represent a new era of financial growth. While there are certainly challenges and risks associated with investing, the opportunities for individuals and the world as a whole are significant. It’s essential to approach investing with a clear understanding of the risks and potential rewards, and to seek advice from trusted financial professionals when needed.

As we move forward, it will be exciting to see how these trends continue to unfold and what new innovations and opportunities they bring.