The Dramatic Crash of MANTRA’s OM Token: Volatility and Trust Issues in Crypto Markets

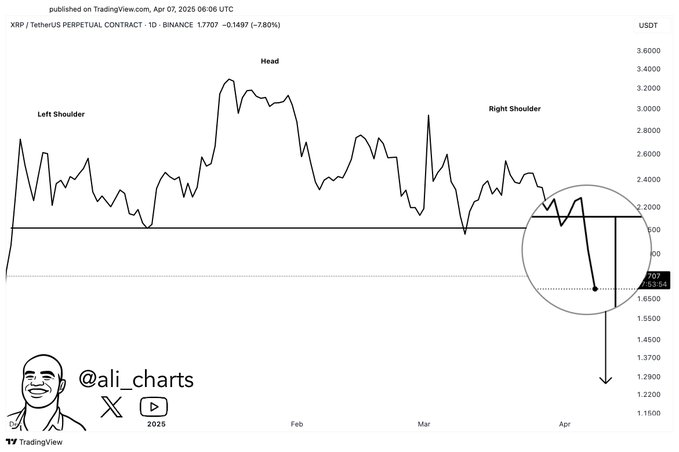

The crypto market is known for its volatility, but recent events surrounding the OM token of the MANTRA DAO platform have raised concerns among investors and industry experts. The token’s value plummeted by over 90% within a short period, causing ripples of doubt and uncertainty.

Background of MANTRA DAO and the OM Token

MANTRA DAO is a decentralized autonomous organization (DAO) that aims to build a community-driven platform for yield farming and investment in the DeFi (Decentralized Finance) sector. The OM token is the native currency of the MANTRA DAO ecosystem, used for governance, staking, and fees.

The Cause of the OM Token Crash

The exact cause of the OM token crash remains unclear. Some speculate that it could be due to a large whale selling off their tokens, while others believe it might be a result of a market manipulation attempt. However, the MANTRA DAO team has vehemently denied any dumping claims.

Impact on Investor Confidence

The sudden and significant drop in the OM token’s value has left many investors feeling jittery. This event could potentially impact the confidence of both new and existing investors in the crypto market and in DeFi projects. The fear of losing money quickly and unexpectedly can deter potential investors and discourage current ones from actively participating in the market.

Effect on Project Credibility

A major price swing in a project’s token can also impact its credibility. In the case of MANTRA DAO, the OM token crash might raise questions about the project’s stability and its ability to manage risk. This could potentially harm the project’s reputation and make it more challenging to attract new users and partnerships.

What Does This Mean for Individual Investors?

- Increased risk: Crypto investments come with inherent risks, but events like the OM token crash serve as a reminder that the market can be unpredictable and volatile.

- Diversification: Spreading investments across various projects and assets can help mitigate the impact of any single project’s volatility.

- Due diligence: Thoroughly researching projects before investing and keeping up-to-date with their developments can help investors make informed decisions.

Global Implications

The OM token crash is not just an isolated event for MANTRA DAO investors. It could have broader implications for the crypto industry as a whole. The sudden loss of value for a project’s token can negatively impact the perception of the entire market, potentially leading to a decrease in institutional and retail investor interest.

Conclusion

The crash of MANTRA DAO’s OM token serves as a stark reminder of the volatility and risks present in the crypto market. While the cause of the price swing remains uncertain, the impact on investor confidence and project credibility is clear. As individual investors, it is crucial to understand the risks involved and to exercise caution when making investment decisions. For the crypto industry, events like these can potentially hinder its progress towards mainstream adoption.