Mantra DAO’s OM Token Crashes: A Billion-Dollar Overnight Disaster

In a shocking turn of events, the Mantra DAO (Decentralized Autonomous Organization) community woke up to find that their OM token had plummeted by an astounding 90% overnight. The token’s value had crashed from its previous high of $7.00 down to a dismal $0.70.

The Devastating Impact on Mantra DAO

This sudden crash has resulted in the erasure of billions of dollars in value for the Mantra DAO community. The total value locked (TVL) in the Mantra ecosystem, which was previously over $3 billion, has now shrunk to a mere $300 million.

The Blame Game: Exchange Liquidations vs. Internal Actions

The Mantra DAO team has attributed the cause of this catastrophic event to ‘reckless exchange liquidations.’ In the decentralized finance (DeFi) world, liquidations occur when a borrower fails to meet the collateral requirements of a loan. Exchanges then sell off the collateral to recoup their losses. In Mantra DAO’s case, it is believed that large-scale liquidations on various exchanges led to the cascading sell-off that caused the OM token’s value to crash.

The Ripple Effect: How This Affects You

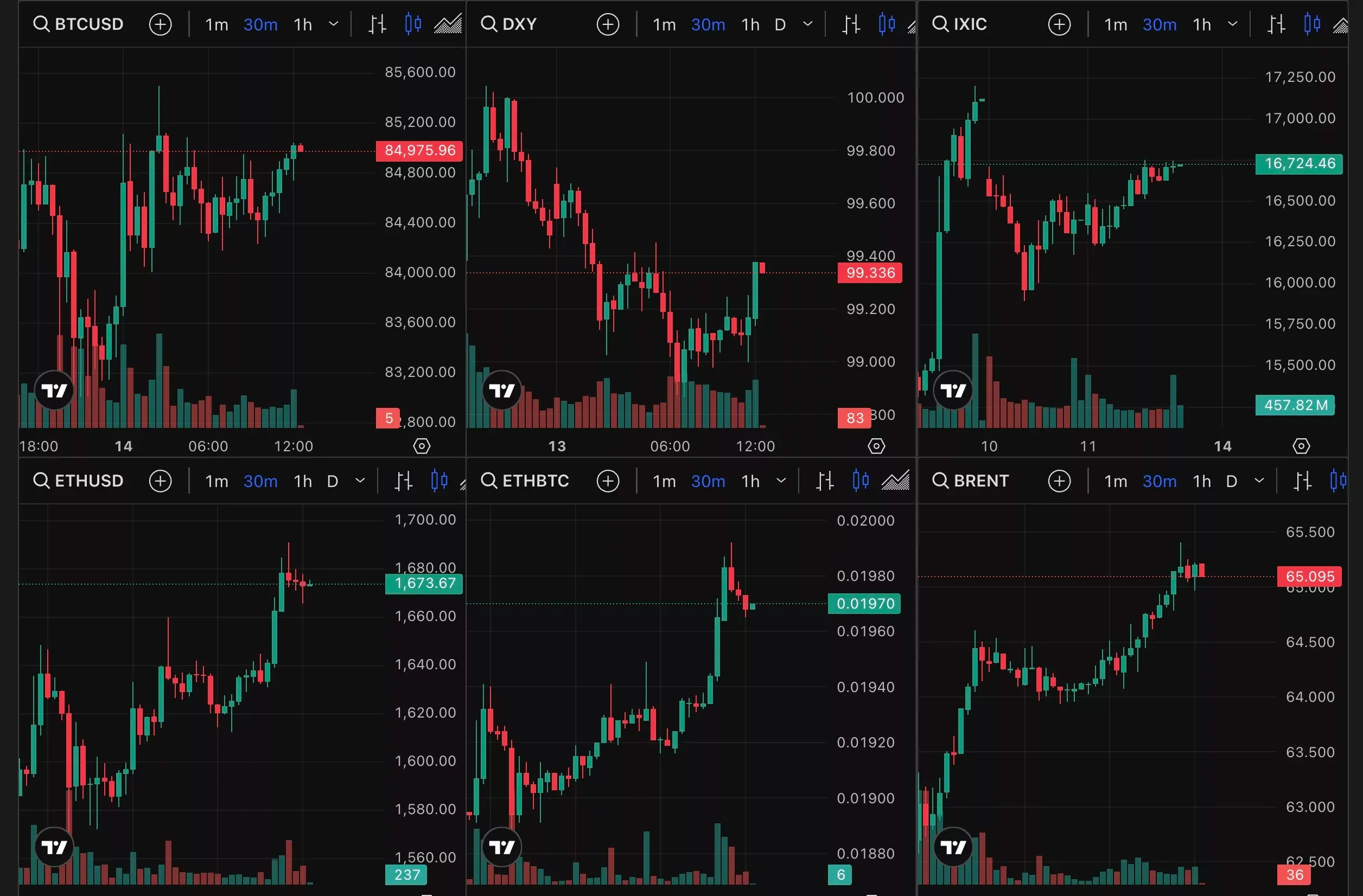

As an investor or a member of the DeFi community, this event could have significant implications for you. If you held OM tokens, you have likely incurred substantial losses. Furthermore, this crash could impact the broader DeFi market, potentially leading to increased volatility and uncertainty.

- Losses for OM token holders: The value of OM tokens has plummeted, resulting in significant losses for those who held the token.

- Uncertainty in the DeFi market: This crash could cause increased volatility and uncertainty in the DeFi market as a whole.

- Impact on other DeFi projects: The failure of Mantra DAO could lead to a decrease in confidence in other DeFi projects, potentially impacting their growth and adoption.

The Ripple Effect: How This Affects the World

The implications of this event extend far beyond the Mantra DAO community. Here’s how:

- Regulatory Scrutiny: This event could lead to increased regulatory scrutiny of the DeFi space, potentially slowing down its growth and innovation.

- Trust in Decentralized Systems: The failure of Mantra DAO could shake investor confidence in decentralized systems, potentially leading to a decrease in adoption and investment.

- Financial Markets Stability: The instability caused by this event could have broader implications for financial markets as a whole, potentially increasing volatility and uncertainty.

Conclusion

The sudden 90% crash of Mantra DAO’s OM token has resulted in billions of dollars in value being wiped out overnight. The cause of this event, according to the Mantra DAO team, was ‘reckless exchange liquidations.’ However, the ripple effects of this disaster are far-reaching, potentially impacting the broader DeFi market, investor confidence, and regulatory landscape.

As investors and members of the DeFi community, it is crucial to stay informed and adapt to the ever-evolving landscape of decentralized finance. This event serves as a reminder of the inherent risks associated with investing in DeFi projects and the importance of maintaining a diversified portfolio.

As the DeFi space continues to grow and mature, it will be crucial for projects to prioritize transparency, security, and risk management to build trust and confidence with their communities and investors. Only then can we truly unlock the potential of decentralized finance to transform the financial industry and empower individuals around the world.